Transfer Pricing Audit Readiness

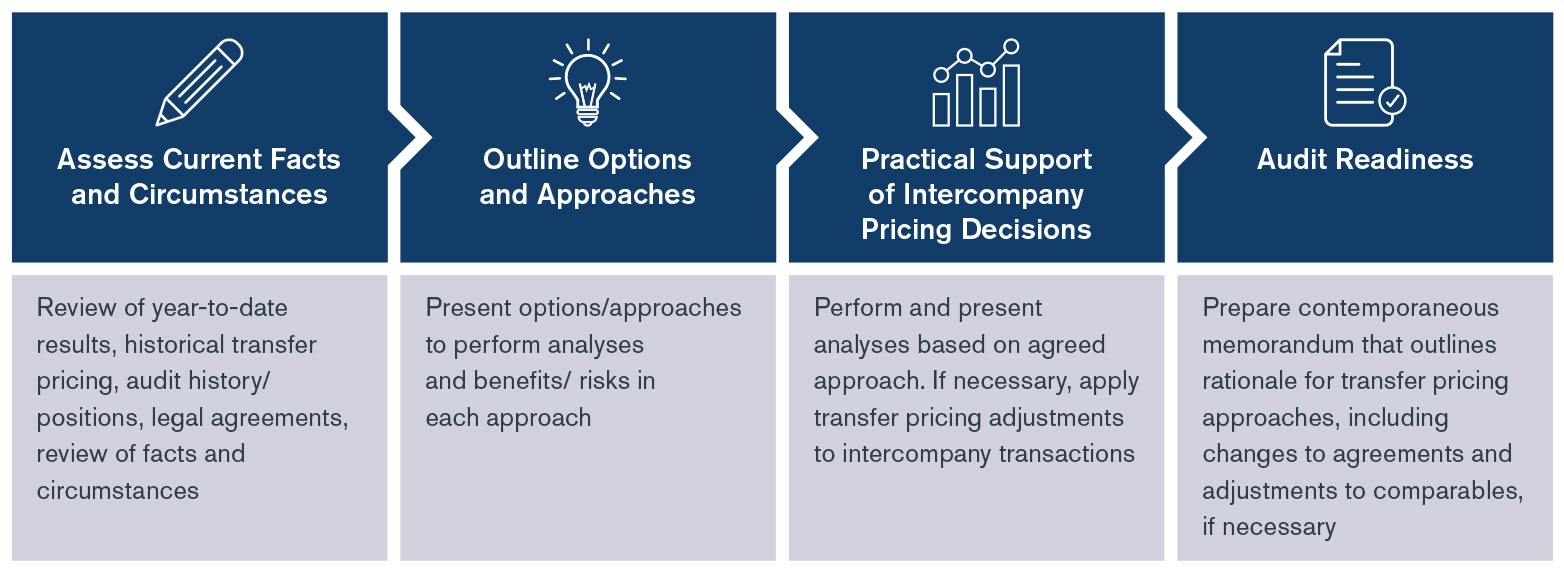

Transfer Pricing Evaluation Framework to Ensure Audit Readiness

Assess Current Facts and Circumstances

Assess Current Facts and Circumstances

The purpose of this initial step will be to identify the specific intercompany transactions (including transactions types and parties to the transactions) that may have been impacted by the pandemic and should ultimately be the focus of this evaluation. It will be important to assess the facts of the subject transactions, such as:

- Review of intercompany agreements

- Comparison of actual practice and legal agreements

- Understanding of transfer pricing structure

- Operating changes that may have occurred during the tax year

- Prior audit positions and future planned changes

Why this step matters: Apart from ensuring there is a clear understanding of facts and circumstances, this step allows all parties to keep the project focused on intercompany transactions that have the most direct impact on meeting tax-related objectives.

Outline Options and Approaches

Outline Options and Approaches

Once all facts have been gathered, this step involves outlining various potential options and approaches that can be taken to support transfer pricing results for the tax year, the steps that would be taken to analyze each approach/analysis, the estimated outcome, and benefits/risks in selecting a particular approach. At the conclusion of this step, decisions are made regarding the approach (method, adjustments, likely impact) that will be taken to support intercompany pricing decisions.

Why this step matters: The approach and outcome to a particular intercompany transaction in 2020 doesn’t occur in a vacuum. Tax departments should be made aware of various approaches and the likely outcome in real-time, enabling informed and insightful decisions.

Practical Support of Intercompany Pricing Decisions

Practical Support of Intercompany Pricing Decisions

This step involves the execution of the analyses agreed upon in the earlier step, which may include:

- Benchmarking (including potential adjustments)

- Tested party cost segmentation and treatment of extraordinary costs

- Year-end transfer pricing adjustments, if necessary

- Revisions to legal agreements, if necessary

- Outline steps to bridge tentative comparable results with final updated results for documentation

Why this step matters: This step is an important and targeted exercise that provides the legal and economic framework for intercompany pricing decisions, including year-end adjustments made during 2020.

Audit Readiness

Audit Readiness

An audit file is prepared to support intercompany pricing decisions made in real time. This audit file will include key elements that will be expected by tax authorities when supporting transfer pricing decisions during extraordinary circumstances, such as industry and company-specific business impacts due to COVID-19, description of the transfer pricing structure, contractual arrangements (including changes/amendments), alignment of COVID-19 business impact to the transfer pricing structure, and economic results (including detailed adjustments considered) to support intercompany pricing decisions.

Why this step matters: The audit file will include analyses and workpapers used to support transfer pricing decisions made in real time during extraordinary circumstances. Further, the audit file can be leveraged when preparing transfer pricing documentation.

Why Kroll

Our team of internationally-recognized transfer pricing advisors provides the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results. Our Transfer Pricing Services are dedicated to offering practical, effective solutions across the full spectrum of transfer pricing and valuation issues any multinational firm may encounter when setting up and maintaining global operations.

For complimentary initial consultations, please complete the contact us form.

For additional information on COVID-19 and managing the risks to your organization, please visit our resource center here.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.