Thu, Oct 17, 2019

How Transportation Options Stack Up For Millennials

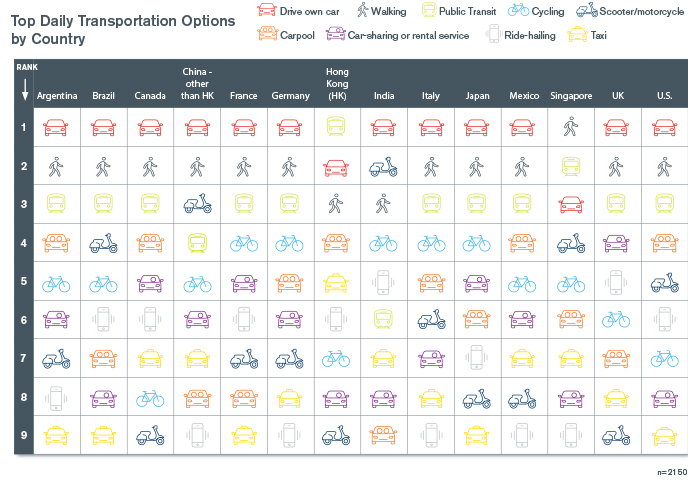

We asked millennials to indicate the frequency with which they use various transportation options. Globally, millennials drive their own car most frequently, without any other option close behind. Additionally, respondents who said they drive their car never or less than once a week was the least frequent response.

Daily Transportation Habits Globally

In Asia, however, more millennials use public transportation relative to the global results, as 51% use it either daily or between two and six times per week. By country, outliers relative to their regions include Mexico, where 42% of respondents carpool either daily or between two and six times per week, a data point that still supports individual car ownership.

In China (other than Hong Kong), a significantly higher number of respondents use their car either daily or between two and six days per week relative to the global results at 87%, supporting extremely high daily commute times in China, which can be as high as almost six hours per day23 in certain cities. Conversely, in Hong Kong, which also has intense traffic, 67% of respondents use public transportation daily or between two and six times per week, followed by respondents who drive their car at 54%, significantly lower than the global and regional results.

In addition, respondents in Singapore rely heavily on public transportation–72% of respondents use it daily or between two and six times per week, followed by walking at 66% and driving their car at 42%. Research indicates24 that Hong Kong and Singapore had the two highest-rated public transportation systems in the world, with high marks for affordability, safety, convenience and rail infrastructure.

In contrast, in India, where public transportation is limited, 89% of respondents use their car either daily or between two and six times per week, whereas only 37% of respondents use public transportation daily or between two and six times per week. Indians also use scooters, mopeds or motorcycles more often than cars, with 57% of respondents using one daily or between two and six times per week.

Taking these findings broadly, millennials use public transportation quite frequently when efficient, cost-effective options are available. It is possible that more government-funded public transportation could be more of a risk factor for automotive industry growth than a purported generational desire to drive less, if governments decide to fund infrastructure spending.

Following up on the frequency with which millennials use various transportation options, we asked them to list their top reasons for choosing each transportation option.

Top Reasons for Millennials Transportation Choice

Based on the results, millennials cited cost, proximity to their destination and reliability as most important. Given the frequency with which millennials drive their cars, they may view driving as more cost-effective, reliable and their best option given the distance they are traveling. In Hong Kong and Singapore, where public transportation is more common, the reasons respondents selected were similar to the global results, providing further support that if public transportation was improved globally, it could reduce car usage.

Sources

23 Shan Xin, “Commuters travel nearly 6 hours a day in China's most congested city,” En.People.Cn, accessed September 25, 2019, http://en.people.cn/n3/2018/0119/c90000-9317374.html.

24 Stefan Knupfer, Vadim Pokotilo, and Jonathan Woetzel, “Elements of success: Urban transportation systems of 24 global cities,” McKinsey & Company, accessed September 25, 2019, https://www.mckinsey.com/business-functions/sustainability/our-insights/elements-of-success-urban-transportation-systems-of-24-global-cities.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Private Capital Markets – Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.

Fairness and Solvency Opinions

Duff & Phelps Opinions is a global leader in Fairness Opinions and Special Committee Advisory, ranking #1 for total number of fairness opinions in the U.S., EMEA (Europe, the Middle East and Africa), Australia and Globally in 2023 according to LSEG (FKA Refinitiv).

Industrials Investment Banking

Industrials expertise for middle-market M&A transactions.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Investigations and Disputes

World-wide expert services and tech-enabled advisory through all stages of diligence, forensic investigation, litigation, disputes and testimony.