Thu, Oct 17, 2019

Millennials Prefer Owning/Leasing a Car Over Ride-Hailing Services

We also asked millennials about the fairly recent phenomenon of ride-hailing services (e.g., Uber, Lyft, Didi). Questions included whether these services were available in their neighborhood, whether they would cost the same as owning/leasing a car with insurance, and whether they would prefer owning/leasing a car or using a ride-hailing service. Overwhelmingly, 75% of millennials chose owning/leasing a car to ride-hailing. The results varied slightly by region, with Latin America at the low end with 66% and the U.S./Canada at the high end at 86%.

Preference in Car Ownership/Lease Vs. Ride-Hailing Services, If the Cost was Equal

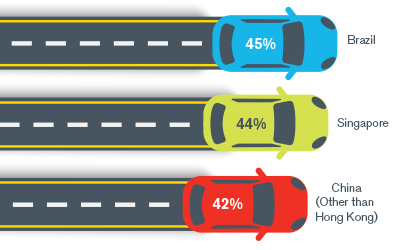

By country, outliers include Brazil at 55% choosing car ownership/leasing, China (other than Hong Kong) at 58%, Italy at 62% and Singapore at 56%. These results, taken together, indicate that when cost is not a factor, millennials prefer to have their own car over using a ride-hailing service.

Brazil, Singapore and China Show the Most Interest in Ride-Hailing Vs. Owning/Leasing a Car Over Other Countries

This preference might have something to do with the high costs of reliance on ride-hailing24 compared to car ownership. Given this significant difference in cost and millennials’ preference of car ownership when cost is not a factor, it does not appear that ride-hailing will likely be a significant threat to car ownership/leasing for the millennial generation.

Source

24 Stefan Knupfer, Vadim Pokotilo, and Jonathan Woetzel, “Elements of success: Urban transportation systems of 24 global cities,” McKinsey & Company, accessed September 25, 2019, https://www.mckinsey.com/business-functions/sustainability/our-insights/elements-of-success-urban-transportation-systems-of-24-global-cities.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Private Capital Markets – Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.

Fairness and Solvency Opinions

Duff & Phelps Opinions is a global leader in Fairness Opinions and Special Committee Advisory, ranking #1 for total number of fairness opinions in the U.S., EMEA (Europe, the Middle East and Africa), Australia and Globally in 2023 according to LSEG (FKA Refinitiv).

Industrials Investment Banking

Industrials expertise for middle-market M&A transactions.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Investigations and Disputes

World-wide expert services and tech-enabled advisory through all stages of diligence, forensic investigation, litigation, disputes and testimony.