Wed, Oct 9, 2019

Can Cost Sharing Mitigate BEAT?

The first U.S. tax returns, including the new Base Erosion and Anti Abuse Tax (BEAT), have been filed and taxpayers who paid the new tax are scrambling to make changes to their intercompany transfer pricing policies before the rate doubles next year. Global taxpayers with significant intangible property (IP) can be particularly affected and many of them are reevaluating their IP structures. This article discusses the interplay of BEAT and one classic form of IP structures: cost sharing arrangements (CSAs).

When Does BEAT Apply?

U.S. taxpayers must meet two requirements to be subject to the BEAT provision. First, they must have a three-year average of gross receipts greater than $500 million dollars. The scope of applicable taxpayers for BEAT is defined to exclude regulated investment companies, real estate investment trusts (REITs) or S-corps. Second, the U.S. taxpayer’s deductions for intercompany payments for services, interest, certain property / assets and royalties must be greater than 3% of its total deductions allowed.1 If a U.S. taxpayer met these two thresholds, it was assessed an additional tax equal to 5% of its the modified taxable income over adjusted regular tax liability in 2018. The tax rate will double to 10% for the years 2019 through 2025, with a further increase to 12.5% after 2025.

How Do Cost Sharing Arrangements Impact BEAT?

CSAs allow related parties to share the costs, risks and rewards of developing specified intangibles. Generally, CSAs may result in platform contribution transaction (PCT) payments which are meant to compensate parties for non-routine contributions made available for purposes of developing cost-shared intangibles under the agreement.2 CSAs also result in cost sharing transactions (CST) whereby the parties make or receive payments associated with their respective intangible development activities. Both PCTs and CSTs are determined so that, after consideration of PCT and CST payments, each party has paid for PCTs and CSTs in proportion to the benefits they expect to realize under the agreement. These payments are typically made on a net basis (i.e. the party who performs R&D in excess of their expected share of cost shared intangible benefits will receive a payment that causes the ultimate share of R&D costs borne to be equal to the party’s share of anticipated benefits from the cost shared intangible).

If a company has an existing CSA, two types of payments are potentially subject to the new BEAT regime: 1) the platform contribution transaction(s); and 2) the controlled participant’s annual intangible development cost share payment.

Why Cost Sharing May Be Good for Certain Companies with Significant BEAT Issues Related to IP

Taxpayers with certain fact patterns may find implementing a CSA beneficial when implementing a BEAT exposure. Specifically, taxpayers paying significant IP royalties or R&D services payments back and forth between U.S. and foreign entities are penalized since companies are not allowed to net service charges or intangible payments for purposes of determining BEAT. In contrast, netting is allowed with respect to CSTs and PCTs, and under these arrangements, BEAT applies only to the netted transaction amounts. Therefore, companies with material amounts of cross-charges related to IP should consider a CSA as a potential tool which might provide a reprieve from BEAT.

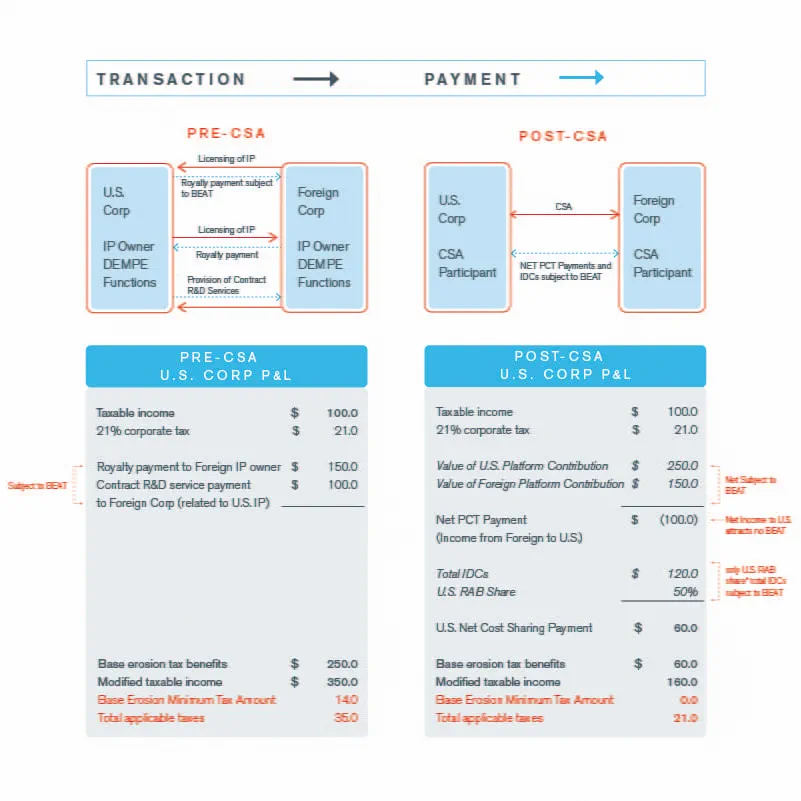

The diagram below provides a simplified case illustrating BEAT implications to CSAs. In the pre-CSA scenario (left hand side of diagram), both the U.S. corporation and its foreign subsidiary own certain IP and exploit global IP. For this reason, royalties are charged between both entities to compensate each for the IP it owns but that is exploited by the other. In addition, while both the U.S. and the foreign subsidiary perform R&D functions associated with the intangibles they own, they also perform R&D on behalf of the other party on a contract basis to some extent (e.g. in the diagram below, U.S. pays its foreign subsidiary for contract R&D services related to U.S. owned IP). Left alone, BEAT would apply to the U.S. taxpayer’s full outbound royalty payment and its payments for foreign R&D services.

A company in this situation could consider contributing IP from each party through platform contribution transactions and sharing costs under a qualified cost sharing arrangement. A key advantage of doing this would be to take advantage of the netting provisions outlined in the U.S. cost sharing regulations. Contrast the pre-CSA scenario with the post -CSA scenario (right hand side of diagram), where the platform contributions as well as the intangible development cost (IDC) sharing payment are subject to BEAT. Because the payments are calculated on a net basis, the BEAT is significantly reduced.

Figure 1: Simplified pre and post CSA example 3,4

For some companies, changes such as those shown above could be material enough to keep the company below the 3% minimum base erosion percentage threshold. The 3% minimum deduction threshold (or 2% for banks and other special entities) creates a cliff effect. If a company does not cross the 3% threshold it owes no BEAT, but once the threshold is crossed the full amount of the base erosion minimum tax amount (BETMA) applies.

Besides mitigating BEAT, there are many other potential benefits of establishing a CSA, such as:

- Ability to better align development, enhancement, maintenance and protection functions related to the IP to the economic and legal ownership when more than one party contributes to and benefits from IP contributions;

- Ease of administering transfer pricing associated with a company’s IP may be better under a CSA than it might be under a system of cross royalties. This may particularly be the case when it is hard to reliably track the generation and usage of IP across the company. In these situations, maintaining royalty structures that are appropriately recognizing intercompany flows can be challenging. CSAs may ease administration by reducing the need to track IP developed under the cost sharing arrangement on a highly detailed basis; and

- While CSAs have been contentious, there is longstanding history around the regulations and established understanding by the IRS. U.S. temporary section transfer pricing regulations on cost sharing were issued in 1995 and the finalized version was issued in December 2011.

When making any changes, a company should ensure that they have evaluated the anti-abuse provisions within the BEAT rules and follow transfer pricing regulations in all countries where entities may experience transfer pricing policy changes.

Sources

1.Certain alternative thresholds are named for banks and special entities.

2.The complete definition of a PCT is as follows: “A platform contribution is any resource, capability, or right that a controlled participant has developed, maintained, or acquired externally to the intangible development activity (whether prior to or during the course of the CSA) that is reasonably anticipated to contribute to developing cost shared intangibles.”

3.To simplify, we assume the company has met the Gross Receipts and Base Erosion Percentage Tests and have focused only on specific impacts of the intangible or CSA-related transactions. We also assume no NOLs, or special credits apply.

4.Note, in the Pre-CSA case, the base erosion minimum tax amount is based on the application of the 10 percent BEAT Tax to the modified taxable income (which is the computed based on the addition of taxable income and outbound payments subject to BEAT) (10%* $350= $35), minus the unadjusted tax liability ($21). In the Post-CSA case, given that the Net PCT payment in fact is income for the US, the base erosion tax benefits amount to the U.S. cost share payment of $60 which is subject to BEAT. Because 10% * $160 - $21 is less than zero, the Base Erosion Minimum Tax Amount is zero in this scenario.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.