Wed, Oct 9, 2019

Coming to Terms with BEAT - How Changes to Intercompany Debt Can Impact BEAT Exposure

Companies who just filed their first returns with a new Base Erosion Anti-Abuse Tax (BEAT) are spending significant resources examining how to reduce or eliminate penalized payments to foreign related parties. Because of their flexibility, intercompany financing transactions are attracting much focus. This article discusses how financing arrangements should be examined in light of BEAT and outlines important considerations when making transfer pricing policy changes to these transactions.

Background on BEAT and Potential Exemptions

The BEAT generally applies to taxpayers meeting the following criteria:

- Gross receipts test: Total average annual gross receipts for the affiliated group exceed $500 million over the prior three-year period;1 and

- Base erosion percentage test: Deductions in the U.S. for intercompany payments for services, interest, certain property/assets and royalties are greater than 3% of total deductions.

- For banks and registered securities dealers, the threshold is 2%.

In general, the BEAT penalizes large companies that have significant outbound payments to foreign related parties. It specifically targets intercompany services, royalties and interest payments.2

For companies that meet the above criteria, the BEAT acts as a form of alternative minimum tax calculation, where a lower rate is applied to an income base that does not include deductions for base erosion payments.

The additional tax payable under the BEAT calculation can be significant. The formula is complex, but as a rule of thumb, 5% of “BEAT-able” transactions could be owed in 2018, and this percentage increases to 10% in 2019 and 12.5% in 2026. As an example, if a company meets the criteria for BEAT to apply and has $100 million of deductions associated with “base erosion tax benefits,” it could pay $10 million in additional tax next year.

BEAT and Interest Payments

If a company passes the tests to be in a BEAT-able position and it has outbound interest payments to related parties, those interest payments will likely attract the BEAT tax. The regulations are broad in application since the tax is defined by a formula that looks at all deductions from payments to related parties, and then layers on potential exceptions. This means that any kind of financing transaction that triggers interest deduction benefits could be BEAT-able, including interest on term loans, guarantee fees, lease financing, cash pooling and similar transactions. Therefore, a company is likely to pay BEAT on its outbound related party interest payments unless it: 1) fails the gross receipts test and/or the base erosion percentage test; 2) does not receive deductions or “base erosion tax benefits” for its related party interest payments; or 3) successfully claims its interest payment transactions qualify for one of a handful of exceptions.

What Exceptions Should be Evaluated?

Even if a company meets the minimum gross receipts threshold the base erosion percentage test and is therefore BEAT-able, it may find relief if certain exemptions apply.

Exceptions are limited, and few are likely to apply to related party interest payments. However, certain specialized companies could consider the qualified derivative payment (QDP) exception or the total loss absorbing capacity (TLAC) exception.

- QDP exception: Section 59A(h) provides that a QDP is not a base erosion payment. QDPs are payments pursuant to a derivative for which the taxpayer recognizes gain or loss on the derivative on a mark-to-market bases, the gain or loss is ordinary, and any gain, loss, income or deduction on a payment made pursuant to the derivative is also treated as ordinary.3 Some companies have contemplated whether financing transactions, if structured properly, could count as a QDP. However, the QDP exception does not apply to a payment that would be treated as a base erosion payment if it were not made pursuant to a derivative.4 Interest rate swaps can qualify in certain circumstances. The regulations outline an example presenting a case of a domestic securities dealer that enters into an interest rate swap with its foreign parent. Under the swap, the domestic company and the foreign parent exchange monthly payments and the domestic company recognizes gain or loss.5 The example concludes that the interest rate swap is a qualified derivative payment and the payments to the parent are not base erosion payments.

- TLAC exception: TLAC is the name given to a unique class of securities issued under principles outlined by the Financial Stability Board of the Bank of International Settlements. These securities are required to be held by certain global systematically important banks to mitigate risks of bank bail-outs. Because of the special status of TLAC as part of a global system to address bank solvency and because the Board of Governors of the Federal Reserve have placed precise limits on TLAC terms and the structure of intragroup funding, the BEAT regulations exclude interest paid or accrued on TLAC securities from the calculation of base erosion payments. This exception applies to only a few organizations, and to only this narrow transaction type within such organizations.

For most corporations, these exceptions will not apply to the majority of their outbound related party interest payments, so these payments could be caught in the BEAT rules.

How Changes to Intercompany Debt Arrangements Can Reduce BEAT Liabilities

For most corporations, the best way to reduce BEAT on related party interest expense payments will be to reduce the amounts of those payments. What kinds of changes tend to lower interest payments?

Policy changes that could lower related party interest payments include:

- Refinancing with lower rates due to changing market conditions

- Refinancing with lower rates due to reduced risk

- Refinancing with lower rates using safe harbors

- Lowering debt amounts through pay-offs

- Securing alternative financing from third parties or domestic entities

Refinancing with Lower Rates Due to Changing Market Conditions

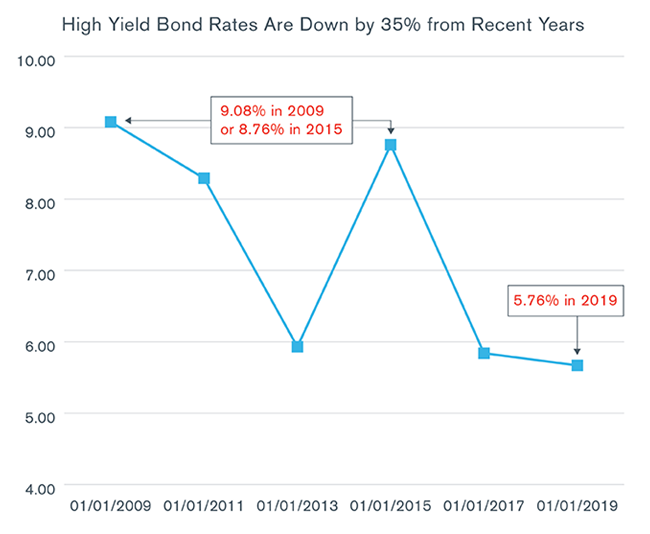

First, taxpayers can consider refinancing their existing intercompany debt arrangements in order to take advantage of lower interest rate conditions. For example, if a company executed a fixed rate intercompany loan agreement at a time when interest rates were higher than today, refinancing with current rates could materially reduce annual interest rate payments. For highly-levered borrowers, this could have a significant impact as demonstrated by the following graph.

If a U.S. entity borrowed $1 billion from a foreign related party in 2009 at a fixed rate approximating the 2009 rates shown above, it could potentially reduce its annual interest expense by $34 million and save $3.4 million in BEAT tax annually.7

When contemplating whether changes in market conditions could cause reductions in interest expenses and associated BEAT payments, it is important to consider transfer pricing regulations guidance on “comparability.” Specifically, when choosing the appropriate market rates for a new loan, benchmarks should reflect comparable factors. An exhaustive summary is outside the scope of this article, but a sample list of comparability considerations is below.

- Contractual terms

- Functions and activities of the borrower and lender

- Amount of the loan

- Term to maturity

- Schedule of repayment

- Purpose of loan

- Level of seniority/subordination

- Geographical location of the borrower

- Currency

- Collateral

- Nature of the interest rate (floating vs. fixed)

- Presence of guarantees

Refinancing with Lower Rates Due to Reduced Risks

Refinancing a transaction with a borrower with improved credit quality, or with a transaction with enhanced contractual terms, can also help reduce interest expense and associated BEAT. If a borrower’s profitability or balance sheet have strengthened since the original loan issuance, it is possible that the entity’s credit rating has improved since the original date. Improved credit standing can have a significant impact on interest rates, and it may be worthwhile to perform a synthetic credit rating analysis using the borrower’s updated financials.

A company can also review its existing loan contracts to see if there are opportunities to refinance such instruments under terms that lower the economic risks for the lender. All else equal, lenders require lower interest rates when the credit risk of the borrower or the transaction is lowered. For example, companies may want to consider modifying the term to maturity such that the arm’s-length interest rate for the revised maturity is lower than that for the existing maturity.

In addition to reducing risk, companies may want to consider their positions on implicit support and potential impacts of new guidance on their evaluations of creditworthiness. Implicit support refers to an improvement in the standalone credit rating of a legal entity borrower due to an expectation that a parent would “step in” and support any debt obligations in case of default. This issue has been highly controversial among global tax authorities and taxpayers, and until recently there was a lack of guidance on the facts and circumstances that warranted an assumption of implicit support. Therefore, many companies did not assume implicit support when pricing related party debt transactions historically. However, the guidance on this topic has been rapidly evolving. The Organization for Economic Cooperation and Development (OECD), a leading authority for global guidance on transfer pricing issues, recently published a draft on intercompany financing transactions that more directly emphasizes implicit support. In the authors’ experience, many tax authorities have been requiring recognition of implicit support in audits and advance pricing agreement (APA) negotiations. A company may want to evaluate the current environment in both the U.S. and the related party jurisdiction to decide whether it wants to revise its policies on implicit support. For transactions that did not previously have an implicit support assumption, including this assumption generally would improve the credit standing of the legal entity borrower and reduce the riskiness of the loan, thereby reducing the rate, the expense and the ultimate BEAT tax.

Refinancing with Lower Rates Through Use of Safe Harbors

The U.S. transfer pricing regulations allow for the use of a safe haven rate called the applicable federal rate (AFR) to price intercompany debt. For purposes of reducing interest payments and lowering BEAT payments, the AFR can be applied where the lender is not engaged in the business of making loans (i.e. not a bank/financial institution), and the loan is denominated in U.S. dollars. The AFR is typically below arm’s-length interest rates for corporate borrowers and lenders as it is based in part on interest rates for government securities. Because of the artificially low rate afforded by the AFR, taxpayers often use this safe haven in situations where the borrower is located outside the U.S. (as foreign tax authorities are unlikely to object to an artificially low rate) and where appetite for tax risk and compliance costs is low. Taxpayers that are seeking to lower their interest payments and reduce BEAT exposure may consider using the AFR, however this likely opens substantial exposure in the foreign lending jurisdiction as taxing authorities abroad are likely to expect to see an interest rate that is above the AFR.

Lower Debt Amounts Through Pay-Offs

Taxpayers can eliminate or reduce outbound interest payments by paying off existing intercompany debt. When contemplating this route, consider whether the borrower has sufficient cash to affect such a transaction. It is also important to revisit intercompany legal agreements to ensure any pre-payment penalty fees are factored into this calculation.

Securing Alternative Financing from Third Parties or Domestic Entities

Finally, if the U.S. entity cannot pay off intercompany debt with its own cash or still requires the full amount of financing, alternative financing arrangements could reduce BEAT. Since BEAT only applies in situations where payments are made to a foreign related party, alternative financing from a domestic entity or a third party could eliminate BEAT issues. Importantly, Example 3 of Section 59A-9 which covers the proposed anti-abuse rules demonstrates that using third-party borrowing to pay off intercompany debt would not necessarily trigger anti-abuse rules. In this example, a domestic corporation pays interest on an intercompany loan (Note A) to its foreign parent. The domestic corporation then borrows money from an unrelated bank through Note B, which has similar terms to Note A. Note B is then used to pay off Note A. The example specifically states that the anti-abuse provisions do not apply to the transaction.8

Conclusion

Companies impacted by BEAT may want to take a hard look at their intercompany financing arrangements. These arrangements are often more easily changed than other transaction types and making appropriate changes to intercompany financing transactions could be an optimal way to mitigate the effects of BEAT on the company’s global tax burden.

Sources

1.The relevant three-year period is that which immediately precedes the current year.

2.Importantly, the BEAT does not affect tangible goods purchases or other Cost of Goods Sold (COGS)-related items

3.Certain documentation requirements also apply for qualification.

4.Section 59A(h)(3) and 59A(h)(4). Note that the proposed regulations specifically requested comments on whether securities lending transactions and sale-repurchase transactions lack a significant financing component so as to be incorrectly excluded from the QDP exemption.

5.In the example, the domestic company also satisfies important reporting requirements.

6.Source: ICE BofAML U.S. High Yield Master II Effective Yield, Percent, Daily, Not Seasonally Adjusted, pulled on 8/28/2019 https://fred.stlouisfed.org/series/BAMLH0A0HYM2EY

7.Assume the original loan of $1B is priced at 9.07%, which creates 90.7 million in annual interest rate expense. A rough estimate of BEAT tax would be 10%* 9.07 million. If the same loan were repriced at today’s rate of 5.67%, annual interest payments would be reduced to $56.7 million, and BEAT tax would be lowered to $5.67m. $9.07m minus $5.67m is equal to $3.4m in savings annually. The savings would increase over time as the scheduled BEAT rate increases to 12.5%. Note that if the interest recipient is in a lower tax jurisdiction than the U.S., any BEAT savings from lowering interest expense payments could be offset by higher income taxes due to lower interest deductions. Companies will therefore need to model the full impact of the change before determining whether their overall position is improved.

8.§1.59A-9(c)(3)(ii)

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.