Kroll Private Equity Risk Detection

Mitigate Deal Risk, Maximize Value Creation

Mitigate Deal Risk, Maximize Value Creation

Kroll Private Equity Risk Detect protects clients throughout the entire deal cycle by scanning digital chatter to spot emerging risks and mitigate business impacts in real time. Kroll uses AI/ML technologies continuously trained over 18 years by expert risk analysts to identify ESG, financial insecurity and cyber risks across the surface, deep and dark web, 24/7. That way, general partners can maximize value creation and manage value preservation in order to ensure future LP funding.

Read more about balancing value creation and preservation in our latest article: The Current Private Equity Dilemma here.

Is your firm at risk? Check the index.

Is your firm at risk? Check the index.

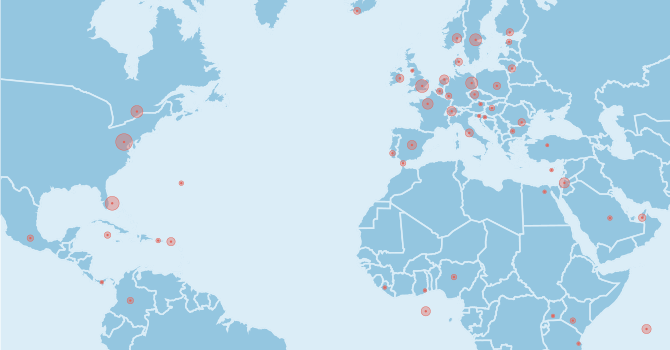

The Kroll Global Private Equity Risk Index ranks the 300 largest private equity firms in the world against five key risk pillars: Environmental Impacts, Social Issues, Governance Failures, Financial Insecurity and Cyber Attacks, analyzing risk signals within digital chatter across the surface, deep and dark web. The index is released quarterly.

Key findings include:

- Digital chatter about a risk event impacting a private equity firm can go undetected, on average, for a period of six months before escalating into a crisis.

- Governance failures pose a growing risk to private equity firms, resulting from a high frequency of perceived poorly managed restructuring and redundancy events.

- Global risk events have heightened private equity firm exposure overall, increasing digital chatter relating to climate change, social unrest and monetary insecurity.

Digital Chatter: An Essential Source of Risk Detection

As the term implies, digital chatter is the summation of conversations happening online that take place across the surface, deep and dark web. It includes open or indexed and closed or dark social media channels as well as forums and messaging apps. Today, risks to private equity emerge via digital chatter faster than ever before, making it an essential source of risk detection for due diligence and ongoing value protection against:

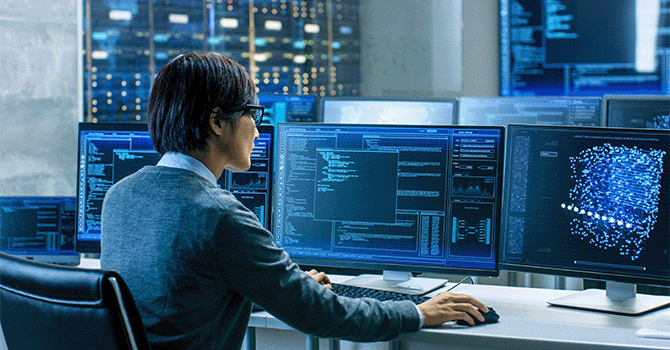

Effective Risk Detection Requires AI + Human Intelligence

Effective Risk Detection Requires AI + Human Intelligence

For nearly two decades Kroll has combined AI/ML technology able to analyze over a billion items per week with Human Intelligence able to continuously label those items and interpret their risk signals on behalf of our clients. This enables Kroll to stay ahead of who, where and what is talked about online, putting digital chatter into contextual, executive-ready actionable risk intelligence and delivering it to our clients, so they are always first to know and first to act.

Total Deal Cycle Protection

Kroll offers risk detection throughout the five stages of a private equity firm’s funding cycle, providing real-time alerts and actionable risk intelligence to general partners, so they’re always first to know and first to act:

Deal Prospecting

Prospect Sector Scan

Kroll offers early risk scanning across five key risk pillars comprising financial insecurity, cyber attacks, social impacts, governance failures and environmental impacts. This is a one-off Prospect Sector Scan delivered on demand and can cover a set of prospects and comparables within a common sector.

Pre-deal Review

Key Risk Single Company Scan

Once a prospective investment has been identified, Kroll performs a deeper dive across the five key risk pillars to deliver a Digital Footprint Report identifying issues that might inform an initial go-no-go decision. This Key Risk Single Company Scan saves deal-costs when discovered before the fuller DD process.

Deal Due Diligence

Deep Single Company Due Diligence Scan

Kroll then performs buy-side a Deep Single Company Due Diligence Scan covering brand reputation risk, C-Suite risks, brand impersonation activity, consumer sentiment (where relevant), compliance issues and analyst comments. The resulting Digital Footprint Report also includes benchmarking against sector comparables.

Post-deal Management

Fund, Portfolio, Third-party Supplier Risk Detection

Post investment, Kroll protects fund value by delivering a set of ongoing detection solutions at the firm, fund, portfolio and supplier level:

- Fund Risk Detection

Across five key risk pillars - Portfolio Risk Detection

Working directly with the asset - Third-party Risk Detection

Across five key risk pillars

Disposal Due Diligence

Deep Single Company Due Diligence Scan

At exit, Kroll delivers a sell-side Deep Single Company Due Diligence Scan reporting comprehensive details of all historic and existing reputational, financial and operational risks. Increasingly buy-side firms are turning to open-source digital chatter to identify latent risks and Kroll allows the asset owner to prepare early for that additional diligence step.

Real-time, 24/7 protection in 50+ languages

Kroll protects all aspects of a private equity firm’s global activities, including the firm’s operations, fund portfolio, portfolio assets and the portfolio’s third-party suppliers. This means real-time, 24/7 protection in 50+ languages for entities associated with the firm, including its reputation, its assets and especially its executives.

Protecting a PE firm’s operations

Protecting a fund’s portfolio

Protecting portfolio assets directly

Protecting portfolio supply chains

Always First to Know, Always First to Act

Always First to Know, Always First to Act

Kroll is a trusted partner to 21 of the 25 largest private equity firms in the PEI 300. Its risk detection expertise is supported by a global network of experienced risk advisors, including 750 risk analysts specializing in signals intelligence, linguistics, psychology, compliance and regulation. With Kroll Private Equity Risk Detect, general partners are always first to know and first to act.

Valuation

Valuation of businesses, assets and alternative investments for financial reporting, tax and other purposes.

Cyber Risk

Incident response, digital forensics, breach notification, managed detection services, penetration testing, cyber assessments and advisory.

Compliance and Regulation

End-to-end governance, advisory and monitorship solutions to detect, mitigate and remediate security, legal, compliance and regulatory risk.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Investigations and Disputes

World-wide expert services and tech-enabled advisory through all stages of diligence, forensic investigation, litigation, disputes and testimony.

Digital Technology Solutions

Enriching our professional services, our integrated software platform helps clients discover, quantify and manage risk in the corporate and private capital market ecosystem.

Business Services

Expert provider of complex administrative solutions for capital events globally. Our services include claims and noticing administration, debt restructuring and liability management services, agency and trustee services and more.

Environmental, Social and Governance

Advisory and technology solutions, including policies and procedures, screening and due diligence, disclosures and reporting and investigations, value creation, and monitoring.