LIBOR Transition Toolkit

Nearly Half of Organizations Still Do Not Have a Firm Libor Transition Plan in Place

A survey conducted by our team in early 2021 revealed that only 45% of organizations polled are prepared to fully decommission LIBOR by December 2021, establishing that there is still a need for support to enable a smooth LIBOR transition process. As the decommissioning deadline quickly approaches, it is crucial for organizations to continue to develop and refine their LIBOR transition plans in accordance with the facts and circumstances of any exposures in their portfolios.

A key initial step in developing your LIBOR transition plan is documenting LIBOR-linked exposures. For additional guidance in this process, our LIBOR Transition taskforce has created a toolkit containing a guide and a customizable template to assist in gathering the appropriate documentation to assess your LIBOR-linked exposures. This includes:

- On-balance sheet LIBOR-linked instruments

- Off-balance sheet exposures, including accounting considerations, valuation and risk management models, third-party vendors, information technology and treasurer management systems

Documenting these exposures is a crucial step in maintaining an up-to-date catalogue of your LIBOR-exposed instruments to allow for a smooth transition plan, in consideration of asset class specific deadlines as they continue to take shape.

LIBOR Transition Toolkit Demo

Watch Jeffrey Fromer, Vice President in our Financial Instruments and Technology group, and Florian Nitschke, Director in Financial Services, Compliance and Regulation practice, walk through how to use our LIBOR Transition Toolkit to document LIBOR-linked exposures.

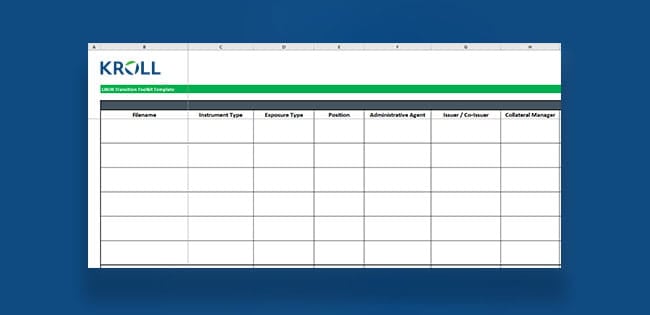

The LIBOR Transition Toolkit Template

The LIBOR Transition Toolkit Template

This customizable template comes with pre-formatted options to help you gather and classify key attributes such as:

- Instrument type (interest rate and cross-currency SWAPs, collateralized loan obligations, etc.)

- Exposure type (asset, liability, hedge, model, third party vendor, etc.)

- Your respective role (issuer, investor, borrower, etc.)

- Existing fallback language, alternative reference rates, and governing jurisdictions

- Contracts which are subject to the ISDA Protocol and/or central clearing

The LIBOR Transition Toolkit Guide

Our guide walks you through the necessary steps to complete your LIBOR exposure assessment. This allows you to parcel out your LIBOR exposures into different categories, which may require a slightly different response for each. For example, contracts referencing the ISDA Protocol may be transitioned with relative ease, whereas others may require bilateral negotiation. Understanding your dependency on third-party vendors allows you to factor them into your transition planning. Considering the use of LIBOR in your accounting practices may have an impact on the timing and sequence of your transition.

After completing the self-assessment, you will have a clear view of your LIBOR exposure and will have taken the first steps towards developing a clear transition strategy. Additionally, our experts are available and ready to assist you with your transition.

How We Can Help

It is important to consider the extent of your LIBOR exposure and the necessary steps involved in its decommissioning. This could include the establishment of a change management project with its own governance and project managers to ensure swift progress and implementation of your transition plan, including documentation of milestones achieved, all in consideration of regulatory guidance and industry practice.

Our experts can assist in the preparation of the LIBOR Transition Toolkit, helping with the identification and documentation of various LIBOR-linked exposures, as well as develop a robust transition plan inclusive of alternatives and updated models.

Our vast array of subject matter experts have the background and experience to handle any steps necessary to mitigate risks associated with the cessation of LIBOR.

Download the Toolkit

Valuation

Valuation of businesses, assets and alternative investments for financial reporting, tax and other purposes.

Cyber Risk

Incident response, digital forensics, breach notification, managed detection services, penetration testing, cyber assessments and advisory.

Compliance and Regulation

End-to-end governance, advisory and monitorship solutions to detect, mitigate and remediate security, legal, compliance and regulatory risk.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Investigations and Disputes

World-wide expert services and tech-enabled advisory through all stages of diligence, forensic investigation, litigation, disputes and testimony.

Digital Technology Solutions

Enriching our professional services, our integrated software platform helps clients discover, quantify and manage risk in the corporate and private capital market ecosystem.

Business Services

Expert provider of complex administrative solutions for capital events globally. Our services include claims and noticing administration, debt restructuring and liability management services, agency and trustee services and more.

Environmental, Social and Governance

Advisory and technology solutions, including policies and procedures, screening and due diligence, disclosures and reporting and investigations, value creation, and monitoring.