Wed, Jul 27, 2016

Transfer Pricing Implications and Scenario Planning

The “out” vote could have two main impacts on the UK transfer pricing environment: (1) freedom from the relevant EU Directives, and (2) movement of companies or financial and other assets into or out of the UK.

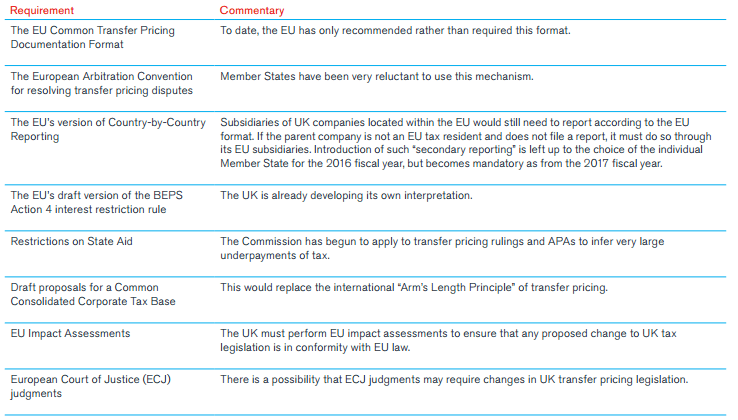

With regard to the EU Directives, the UK may cease to be obliged to comply with the EU's transfer pricing framework that includes the following requirements:

To the extent that the EU’s Directives which bear on transfer pricing are broadly designed to implement the Organization of Economic Co-operation and Development’s (OECD’s) guidance in this area, which itself is explicitly embodied in the UK’s transfer pricing legislation, the impact of Brexit on UK transfer pricing might not be so dramatic. More generally, the UK may choose to comply with certain relevant Directives in order to avoid EU sanctions, or a post-Brexit deal with the EU may require the UK to accept certain EU Directives and/or the jurisdiction of the ECJ in certain matters. This would be the case, for example, if the UK were to pursue either of the following routes:

-

A European Economic Area (EEA) Agreement which brings together the EU and three of the European Free Trade Association (EFTA) States (Iceland, Liechtenstein and Norway) in the “Internal Market” and provides for the inclusion of EU legislation on the free movement of goods, services, capital and persons, and establishes common rules on competition and State Aid. However, the UK would not have to comply with EU tax Directives and the jurisdiction of the ECJ

-

A Bilateral Agreement with the EU such as the series between Switzerland and the EU. The UK would negotiate the best deal that it could achieve with the EU – for example, in addition to not being subject to EU tax rules, Switzerland is not subject to EU State Aid rules

It should be noted that the EFTA is not an EU-affiliation mechanism, amounting only to a free trade agreement between its four members (Iceland, Liechtenstein, Norway and Switzerland) for goods and services, together with some coverage of areas such as investment and the free movement of persons. Thus, even if the UK were to join the EFTA, it would still be obliged to negotiate its relationship with the EU within one of the two mechanisms outlined above (EEA or Bilateral). Depending on market sentiment after a Brexit, relative confidence in the UK economy may cause companies to move their assets or operations to or from the UK, with transfer pricing implications and requirements that could include the following:

-

Debt capacity and interest rate reviews for new investments

-

Comparison of alternative Intellectual Property (IP) holding jurisdictions, IP valuation and transfer and royalty rate reviews

-

Supply chain reviews including risk allocation and centralization of high value functions

-

Resolution of existing transfer pricing audits or litigation

Other implications for Funds include debt capacity and interest rate reviews for new private equity investments and banks and financial institutions may require due diligence of multinational borrowers’ after-tax financial forecasts.

Conclusion

In terms of an immediate transfer pricing response to what is still only the possibility of Brexit, and a Brexit that could take a wide range of forms, we recommend that businesses should prepare for the possibility of having to replace or top up third party finance with related party finance. In addition, they should also begin (as a precautionary measure) to consider alternative locations for their IP and their activities, taking into account a lower UK exchange rate and tax rate, but potentially less access to European markets and a higher cost of capital. Finally, they should consider whether transfer pricing “bench-marking” studies might need to be updated sooner than planned.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.