Tue, Sep 23, 2014

BEPs: Action plan released and UK first to adopt country-by-country reporting

The project is designed to create a single set of international tax rules to end the erosion of tax bases and the artificial shifting of profits to jurisdictions to avoid paying tax. This was released prior to the G20 finance ministers meeting in Cairns, Australia on 20-21 September 2014. On 22 September the UK was the first of the 44 OECD countries to formally adopt the country-by-country reporting requirement. The plan is widely regarded as one of the most significant overhauls in the international tax system ever to be witnessed and ushers in a new era of transparency and fairness.

At the request of the G20 Leaders, the OECD’s work is based on a BEPS Action Plan setting out the 15 key elements to be addressed by 2015. The project aims to help governments protect their tax bases and offer increased certainty and predictability to taxpayers, while guarding against new domestic rules that result in double taxation, unwarranted compliance burdens or restrictions to legitimate cross-border activity.

The first seven elements of the Action Plan released on 16 September focus on:

A. hybrid mismatch arrangements;

B. prevent the abuse of tax treaties;

C. transfer pricing issues in the key area of intangibles;

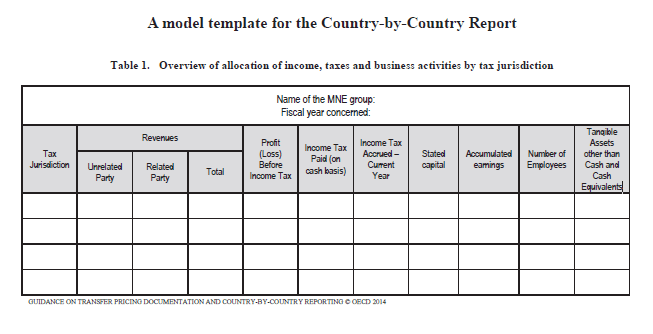

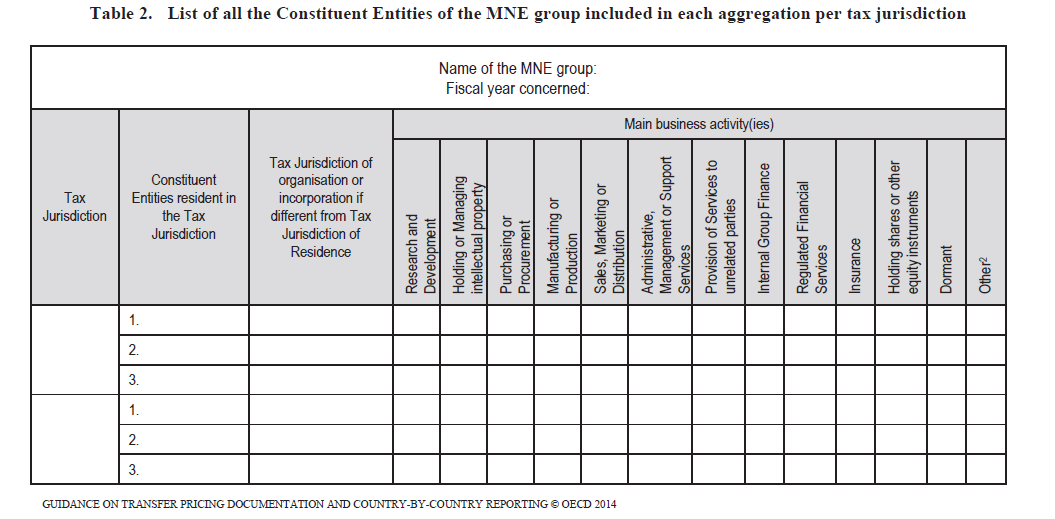

D. transfer pricing documentation and a template for country-by-country reporting;

E. challenges of the digital economy;

F. feasibility of developing a multilateral instrument; and

Governments are expected to adopt the recommendations into local statute during 2015 along with the remaining eight recommendations to be released next year. However, the UK, keen to show their backing for the recommendations, has already formally committed to adopting the templates recommended by the OECD for country-by-country reporting, set out in Table 1 and 2:

What should taxpayers be doing?

Taxpayers who are evaluating their transfer pricing position, be it either for the first time or reviewing existing practices, should be cognizant of the international policy shift in transfer pricing. Governments will soon have an unparalleled level of information and businesses operating transfer pricing policies that do not comply with international standards will come under increasing scrutiny.

Financial Services Compliance and Regulation

End-to-end governance, advisory and monitorship solutions to detect, mitigate, drive efficiencies and remediate operational, legal, compliance and regulatory risk.