Mon, Mar 11, 2019

Building Products and Materials Industry Insights - Winter 2019

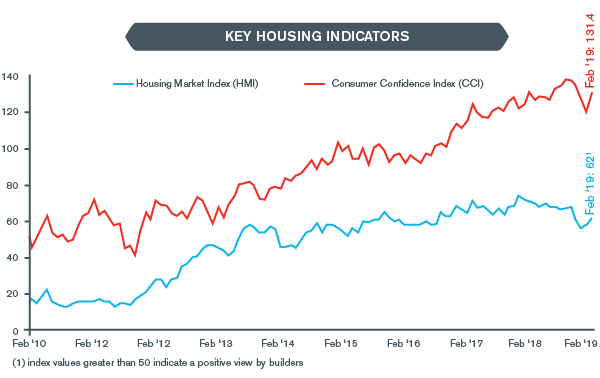

Housing activity was robust for most of 2018, but certain headwinds create uncertainty for the future.

Despite a strong job market and demand from maturing millennials, existing home sales, which make up about 90% of all home sales, fell 3.1% due to high home prices, rising mortgage rates and low supply of available homes, especially at the entry level.

Both housing starts and building permits were up modestly in 2018; however, housing starts fell to a more than two-year low in December 2018 due to rising labor and materials costs, shortage of land, and weakening housing demand.

Multifamily starts were up 5.6% while single-family starts were up 2.8% in 2018, marking a reversal from 2017, when single-family starts outpaced multifamily starts.

Remodeling activity remains strong, despite weakness in sales due to the upward trajectory of home prices, as well as strong consumer confidence and a robust economy with steady job and wage growth.

Strong demand and low inventory levels drove home prices higher in all markets in 2018, but the 20-city index increased at its slowest pace since 2014, indicating that prices are beginning to level off.

The stock performance of all subsectors of the industry have underperformed the S&P 500 Index over the past 12 months, reflecting investor concerns about the near-term future of the industry.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Industrials Investment Banking

Industrials expertise for middle-market M&A transactions.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Bankruptcy Litigation and Solvency Disputes

Expertise in disputes involving fraud, valuation, solvency, governance, plan treatment, and avoidance actions in the bankruptcy or insolvency context.

Distressed M&A and Special Situations

Kroll professionals have advised hundreds of companies, investors and other stakeholders at all stages of distressed transactions and special situations.

Private Capital Markets – Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.