Mergers & Acquisitions (M&A) deal activity in the food and beverage industry remains strong, with 283 deals closing in the last 12 months (LTM) to March 31, 2019. The market witnessed two major transactions in the first quarter of 2019 – the acquisition of The Schwan Food Company Inc. by CJ Foods America Corp. closed on February 25, 2019, which valued the company at $2.2 billion, and the acquisition of Blommer Chocolate Company by Fuji Oil Holdings Inc. closed on January 1, 2019, with a value of $750 million.

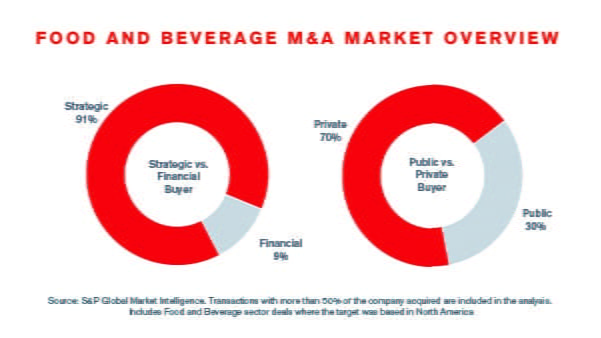

M&A activity in the Food and Beverage industry is still predominately driven by strategic buyers (including companies primarily owned by private equity investors), with strategic transactions representing 91% of total deal flow over the LTM. Of the 283 deals closed in the LTM, 199 (70%) were completed by privately owned buyers.

Overall deal volume in the LTM to March 31, 2019 remained relatively in line with last year, only 5.4% lower than the 299 deals closing over the previous 12-month period.

The beverage sector continues to be an active space for M&A, with 47 transactions completed by alcoholic beverage companies and 40 deals completed by non-alcoholic players in the LTM. Sports nutrition and health-based brands are a key focus area for strategic buyers, reflected by PepsiCo’s announced acquisition of CytoSport for $465 million in February 2019.

In Canada, the cannabis space is a dynamic sector for M&A, including food and beverage transactions. In February 2019, cannabis producer Tilray closed the acquisition of Fresh Hemp Foods, which is just one of many examples of the growing cross section between food and beverage, and cannabis.

The strong deal flow is likely to continue as the fundamentals remain supportive of M&A activity and many private food and beverage companies may be contemplating exit strategies. This may provide opportunities for well-capitalized companies to acquire prime assets or merge to support growth.

Sources: Capital IQ as of March 31, 2019.

Note: M&A deal count is defined by a list of subsectors viewed as the best representation of the industry.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Consumer Investment Banking

Consumer, Retail, Food and Restaurant expertise for middle-market M&A transactions.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Fairness and Solvency Opinions

Duff & Phelps Opinions is a global leader in Fairness Opinions and Special Committee Advisory, ranking #1 for total number of fairness opinions in the U.S., EMEA (Europe, the Middle East and Africa), Australia and Globally in 2023 according to LSEG (FKA Refinitiv).

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Distressed M&A and Special Situations

Kroll professionals have advised hundreds of companies, investors and other stakeholders at all stages of distressed transactions and special situations.

Private Capital Markets – Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.