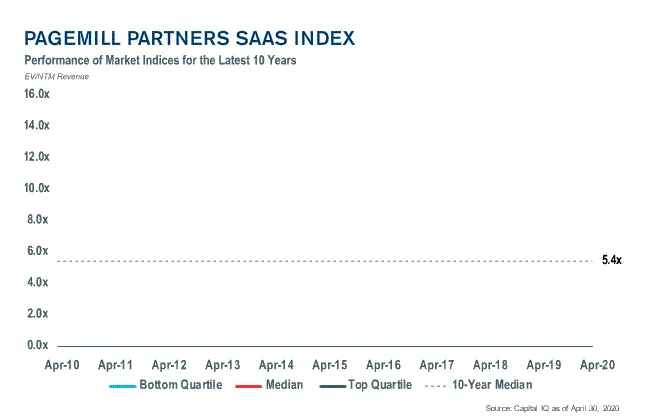

COVID-19 headwinds are impacting M&A deal activity and valuation multiples after a robust start to the year. While first quarter deal volume and value is consistent with recent quarters, we have seen a decline in median deal multiples from 2019’s record high of 4.5x trailing revenue to 3.3x in the most recent quarter.1 In contrast to this is the strong recovery in public market valuation multiples, which are back above historic trends and in some cases close to all-time highs.

The impact of COVID-19 on deal activity in April can be seen in the 29% and 90% reduction in technology M&A deal volume and value respectively, when compared to monthly averages for 2019.1 However, while restricted access to credit has significantly impacted highly leveraged, larger-cap deal activity, the more strategically-driven, bolt-on deals continue to feature, with notable deals in April including Pagemill Partners’ client Fluidmesh’s sale to Cisco, TA Associates’ MRI Software acquiring Castleton Technology and Apple’s acquisition of Voysis.

While the market disruption impacts all businesses, certain sectors are clearly weathering the storm better, such as enterprise collaboration, communications, cyber security and digital commerce, which are showing resilience and in some cases seeing an uplift in utilization. Public market valuations for these sectors are in some cases already back to pre-crisis levels, and we expect to see increased M&A activity in these sectors in the coming months.

Source

1 451 Research as of April 30, 2020

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Private Capital Markets – Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.