M&A Updates

Special Purpose Acquisition Companies—2023 Year End Review and 2024 Outlook

by Bob Bartell, CFA, Mark Kwilosz, Stephen Burt, Chris Janssen, Jennifer Terrell, Raphael (Ray) Newman

COVID-19 has presented the entire investment community with an unprecedented challenge, and many major economies find themselves in unchartered territory. Lockdowns are being lifted, but is the worst economic damage yet to come?

At Kroll, our Real Estate Advisory Group (REAG) wanted to find out more about how global real estate markets were coping during this extraordinary time in investment history. REAG prides itself on real estate consulting services that help clients maximise the value of their real estate holdings, so gathering as much information as possible about the current situation was an obvious step.

Leveraging our unique expertise and contact network, alongside the GRI Club—the world’s largest real estate club—we carried out an extensive survey of the commercial real estate industry to glean insights and help fuel decision-making at such a critical time.

We surveyed 325 senior directors within the commercial real estate industry; the majority (54%) were from the EU, with the U.S . accounting for the next largest subset of respondents (25%). With 18% of respondents being from the UK, we can safely assume that the perspectives they offer will reflect how real estate activity is faring in developed markets.

In terms of their business activity, the lion’s share of respondents worked in private property companies (38%) or publicly listed property companies, including REITs (38%). Investment managers accounted for 14% of survey respondents.

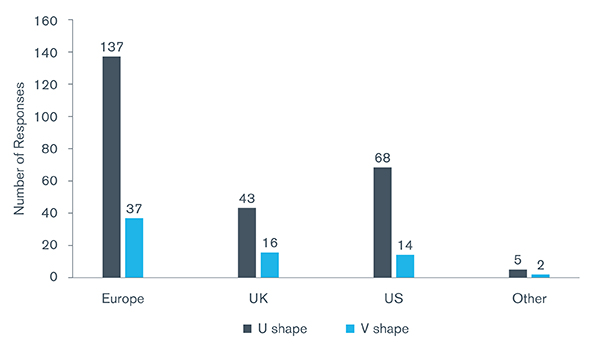

With economic downturns already confirmed in some major markets, it’s perhaps little surprise that a global recession has been identified as the biggest risk for the European real estate market. The majority of respondents (64%) fear the impact of a recession on European commercial real estate markets, with almost 80% believing the recovery will be U-shaped and not sharply correct like in a V-shaped recovery. Respondents from the U.S. also believe a U-shaped recovery was most likely to happen (83%) for their own economy.

What Will Be the Shape of the Economic Recovery in Your Country?

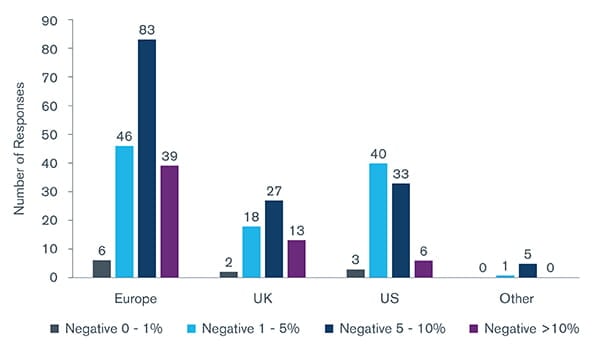

When asked about how the COVID-19 pandemic had impacted their own country’s GDP growth, most respondents anticipated significant contractions of between 5%-10%. This was according to 45% of respondents, with 32% indicating they expected a 1%-5% impact and a worrying 18% anticipating damage to be over 10%. From a geographic perspective, it was telling that nearly half of U.S. respondents (49%) optimistically saw damage to be minimal, between 1%-5%, in contrast to those from Europe and the UK.

What Impact Do You Expect the COVID-19 Pandemic (and Related Restrictive Measures) to Have on Your Country's GDP Growth?

Across the board, our survey found agreement that valuations will suffer. Nearly four out of 10 respondents (39%) expect valuations to fall by between 5%-10%, but this was closely followed by 31% who feared a heavier impact. Stronger consensus was found when we asked when valuations may start to creep back to their pre-pandemic levels, with 90% hoping this would happen in 2021.

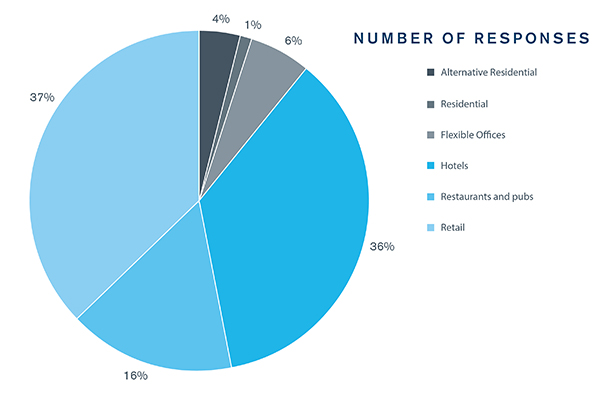

COVID-19 is unprecedented in its impact on so many businesses, with blanket lockdown rules effectively shutting down entire sectors for months. However, the damage was not uniform, as some business sectors cannot be taken online as easily. It’s therefore no surprise that our respondents expect the worst long-term damage in commercial real estate to be among retail, hotels and restaurants and bars (accounting for 37%, 36% and 16% of responses, respectively). It’s a well-known fact that all of these sectors (hospitality, in particular, accounting for just over half of all responses) have struggled during the pandemic. As a result, commercial real estate investors will naturally be looking elsewhere for assets that have proven to be more pandemic resistant.

In the Long Run, Which Real Estate Sector Will Be the Hardest Hit by the Current Crisis?

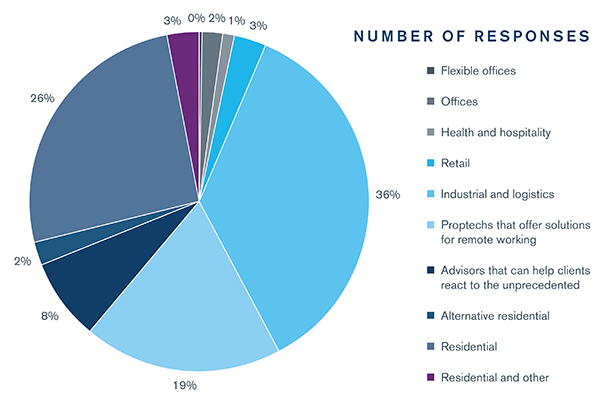

This is perhaps why more than a third of respondents (36%) believe the industrial and logistics sector will emerge the strongest from the current crisis. With an increase in online shopping brought on by the pandemic, the importance of “last mile” facilities—logistics warehouses that carry out the final step of delivery—will become increasingly important. Tellingly, more of our respondents expect to see growth in residential assets over traditional offices premises (26% versus 2%).

In the Long Run Which Sector Do You Think Will Emerge the Strongest From the Current Crisis?

However, investors may take comfort in the fact that most respondents said they were slightly more optimistic about the European real estate sector than they were at the start of the pandemic (34%). European respondents were the most optimistic in their responses with over half (52%) having a more positive outlook. Encouragingly, only nine percent of respondents have a more pessimistic view of European real estate than at the start of the crisis. Interestingly, the more alarming outlook is coming from the U.S., where half of U.S. (49%) of respondents said they were less optimistic about the future of the European real estate market than at the start of the lockdown.

Despite this mixed and at times gloomy picture, we wanted to find out how our respondents were poised to take advantage of valuation opportunities when they did appear. Encouragingly, 70% said they could deploy capital when needed. In addition, nearly all the funds and investment managers surveyed responded affirmatively to this question, which dispels some of the concerns about liquidity associated with this area of investment.

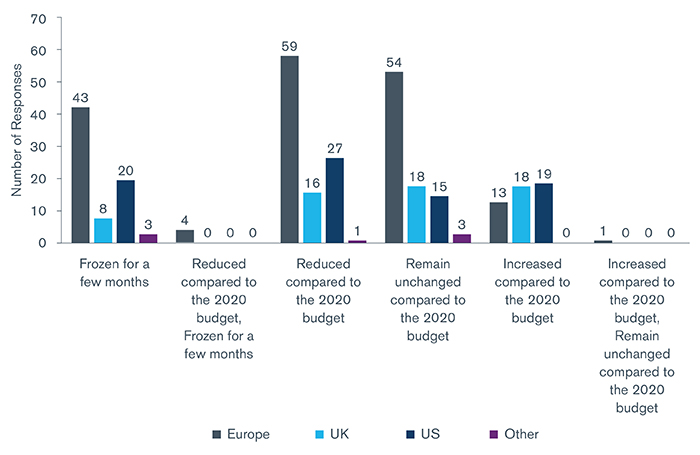

However, it appears that private property companies would lag in their response to receive approval and take advantage of these opportunities (respondents were split nearly 50/50 on this query). So, it’s no surprise that 41% of those responding who said they did not have the capital ready, would be freezing their commitments for a few months. Elsewhere, 15% of respondents are set to increase their capital requirements.

Following the Crisis, How Do You Plan to Behave in Regard to Your Capital Commitments in Real Estate (Investments and/or Financing) in 2020?

When it comes to real estate financing in general, nearly four in 10 respondents (38%) expect non-performing loans to grow in number. These are when the borrower is in default, which reflects the economic fallout that many see as inevitable. Given the huge amounts of monetary policy stimulus being greenlit, 20% of respondents see central bank injections as highly probable, but only 16% expect banks to be replaced by other lenders. Worryingly, 25% admit they see some asset classes as no longer eligible for funding at all, which suggests the damage may be too serious for some business models that rely on physical premises.

Europe and the U.S. seem to be coming out of the worst of the pandemic, although this may change as we head into the autumn and winter. Nonetheless, some sectors of the market have proved remarkably resilient, particularly prime city centre offices and logistics properties. These values so far seem to have been maintained.

If governments shut down world economies, you can expect enormous short-term change. But the degree of pessimism is starting to subside for most.

What does the future hold for hospitality and leisure? Are skyscrapers sustainable? What are we going to do about retail?

To get further insight into the survey and these further questions, please contact us or listen to our webinar “Impact of COVID-19 on Global Real Estate – Kroll / GRI Survey.”

Leading provider of real estate valuation and consulting for investments and transactions.

When companies require an objective and independent assessment of value, they look to Kroll.

by Bob Bartell, CFA, Mark Kwilosz, Stephen Burt, Chris Janssen, Jennifer Terrell, Raphael (Ray) Newman

by David Scott, Miguel Peleteiro, Diogo Pais

by Umakanta Panigrahi, Aviral Jain, Sanjay Ray