Forensic Investigations and Intelligence

Foreign Bribery Reform in Australia - a long-awaited reform to Australia’s Foreign Bribery Framework

by Cem Ozturk, Gary Gill, Sergio Revilla , Amanda Wood

Mon, Apr 20, 2020

The promise of 5G (the fifth generation of wireless technology) to advance mobile technology in speed, number of permissible connections, latency, capacity and reliability has been much heralded—mostly by carriers. They will tell you that 5G has the ability to vastly improve communication between people and the growing ecosystem of connected machines around them. The reality, however, is that the wireless industry’s current 5G capabilities and the way they are marketing this next-gen technology, are complicated and not altogether clear.

After years of hype, carriers like AT&T, Inc., Verizon Communications, Inc., and the “new” T-Mobile USA, Inc. (having closed its acquisition with Sprint Corp on April 1, 2020) are outwardly targeting 2020 as the year to finally provide clarity on what their 5G cellular networks can realistically achieve. If the shift to 5G feels like it’s been taking a long time to arrive, well, it has. In 2019, these major carriers flipped the switch on their 5G networks in a small number of cities, and handset makers released only a handful of phones compatible with the new standard (yes, 5G requires a new device). There was, however, no overwhelmingly meaningful improvement to cellular networks for the average consumer.

In fact, if the goal of wireless carriers has been to have consumers think they’re using a 5G network even if they aren’t, then the industry’s strategy has been a rousing success. AT&T, for example, made 5G extra confusing in 2018 when it rebranded parts of its existing 4G network as “5GE.” So, AT&T customers with older 4G-compatible phones started seeing a “5GE” status icon on their screens. AT&T also labeled portions of its 5G network where it uses an ultra-high-band spectrum known as millimeter wave (mmWave) to provide what it calls a faster 5G service, as “5G+” (available in 35 cities as of March 20201 and yes, requires a new device).

According to a Strategy Analytics survey of smartphone owners conducted in July–August 2019, 29% of AT&T’s customers surveyed responded they already have 5G. This “fuzzy” marketing will likely be problematic for the operator when it needs to convince those customers that they actually need to upgrade to 5G or 5G+. AT&T customers aren’t the only ones confused. Across all U.S. carriers, 37% of survey respondents thought they already had 5G even though they probably did not.2 Again, this confusion will make it more difficult for carriers to explain to consumers why they need to upgrade their devices (and pay a premium price for that next-generation smartphone) when they already thought they were receiving 5G.

What’s Been Keeping 5G On Hold?

While the hype around 5G has been building for years, it is finally becoming a reality, however, slowly and with severe limitations. This fifth generation is being rolled out in cities across the U.S. and around the world, and new phones are slowly coming equipped with 5G capabilities, led by Samsung. Apple anticipates an iPhone 5G release in the fall of 2020.

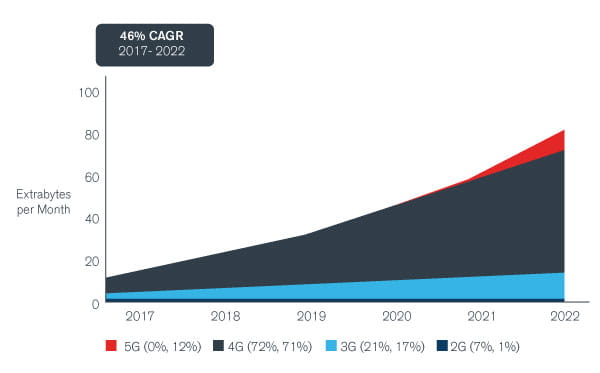

But the reality is that any substantial impact of 5G from a data traffic and connectivity standpoint is expected to take at least three more years. A Cisco Systems white paper3 from February 2019 predicts that only about 12% of global mobile data traffic will come from 5G connections by 2022:

So, why is it taking so long to roll out 5G? Two reasons:

We explore each of these reasons in later sections.

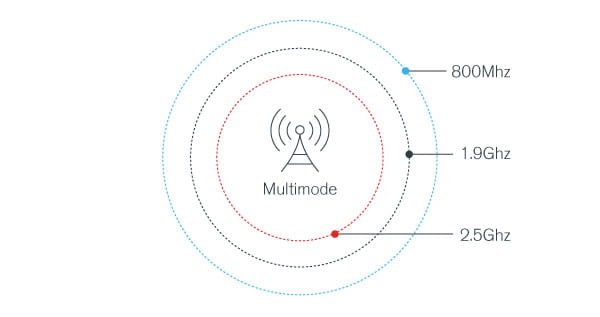

To identify the challenges, I find it essential to understand the science behind the spectrum.

The electromagnetic waves that make up the spectrum operate similarly to physical waves, with common characteristics such as frequency and wavelength.

The generation of radio waves is strictly regulated by the government in most countries, coordinated by an international standards body (International Telecommunication Union, or ITU) and assisted by organizations like the Institute of Electrical and Electronics Engineers (IEEE). They promote efficient use by defining the rules. In the U.S., the regulation of radio spectrum usage and the management of spectrum inventory is handled by the FCC. Certain bands of radio frequency are set aside for wireless services to be managed by the FCC’s Wireless Telecommunications Bureau (WTB). These are the frequencies that get auctioned off by the government for licensed use.

Think of spectrum like a highway. The cars and trucks on the road represent the data bits, while the lanes of the road represent the bandwidth.

How do we move more cars and trucks (data bits)? One of two ways:

Ideally, we’d all be driving at 150 miles per hour on the freeway so we can get to where we’re going, right? Well, the problem is vehicles have speed limits, both legal and theoretical (friction and drag at high speeds become a bottleneck). Similarly, radio transmitters and handset modems in their current form also have a bottleneck—the theoretical maximum rate at which information can be transmitted over a communications channel of a specified bandwidth. This “speed limit” is known as spectral efficiency (measured as megabits per second per MHz, or miles per hour per lane, in our highway example), and it’s really, really hard to increase this number.

That leaves us with the second solution: add more lanes. Instead of building a 10-lane or 20-lane highway, you build a 100-lane highway. Same goes with bandwidth for 5G: instead of deploying a block 10-20 MHz wide, you deploy a 100-MHz “super-highway” and get many more of those data bits to their destination.

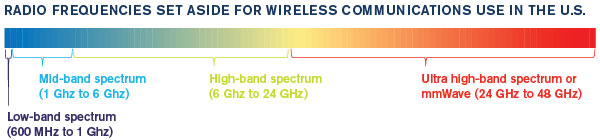

But again, the problem isn’t the lack of spectrum; it’s the lack of contiguous space for a single carrier to operate a 100 MHz-wide super-highway. The FCC historically auctioned smaller channel sizes, so most of the “good” lower frequencies across the U.S. are dotted with carriers, each running their own little 10-20 MHz highways right next to each other. As it turns out, the only frequencies that have the space available (100 MHz and up) are in mmWave. The diagram below shows how vast mmWave spectrum occupies; it comprises over half the total available spectrum in terms of bandwidth.

And there’s a twist. It turns out, running 5G on higher frequencies also has a synergistic effect of actually improving the spectral efficiency. For low-band frequencies, 5G improves spectral efficiency by 19% over 4G’s Long-Term Evolution (LTE).4 However, for mid-band frequencies, 5G improves spectral efficiency by 52% over 4G LTE.5 The improvement is probably north of 100% for mmWave. If you deploy hundreds of MHz at mmWave frequencies, you can deliver on the gigabit speeds that marketing seems to be promising everyone. But as we’ll discuss later, it just isn’t practical to expect mmWave to be available to every American.

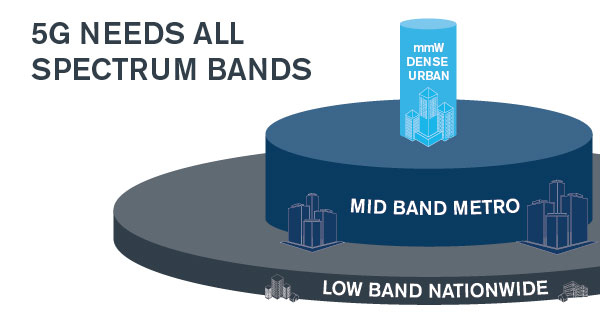

T-Mobile recently published a “layer-cake” analogy 6 to illustrate how the various frequencies of 5G will operate on their network (you can expect every major carrier to deploy frequencies in a similar manner):

The radius of each layer represents the coverage (reach) of the frequencies, while the layer heights represent the capacities (speeds) that the frequencies can attain. The mmWave frequencies on 5G can reach gigabit speeds, while low band 5G is only marginally better than 4G LTE. And mid-band is somewhere in the middle, albeit closer to low-band speeds than mmWave. (Interestingly, Sprint’s vast portfolio of mid-band spectrum was frequently cited as the #1 reason for T-Mobile’s purchase; they want as much balance between coverage and capacity as possible for their 5G service.)

The fact that mmWave can only travel short distances is a critical flaw of the 5G rollout. Carriers will need much more “fill-in” infrastructure to operate a mmWave network—more antennas within a block, a public event space, a shopping district or an entire downtown. The prospect has inspired a 21st century urban battle between telecoms that want to deploy their hardware everywhere and cities that want to minimize (or at least standardize) their appearance. At least 30 state legislatures have passed legislation in favor of the telecom industry and stripped their cities of the ability to control deployment of 5G infrastructure and the costs that it could cause.

All of this leads to an enormous financial and legal burden to even entertain the idea of providing wide scale mmWave service, which is why only the most prominent telecom companies are exploring these buildouts. These major players anticipate rolling out 5G technology in highly populated urban areas to reach most of the people and maximize their investment. The existing low and mid-band infrastructure in these urban areas effectively takes a back seat and could even be seen as superadequate. What is the value of infrastructure that only gets used to run a substandard network?

Carriers are providing vastly different frequencies of 5G as they try to provide coverage to as many people as possible as quickly as they can. But they simply don’t have the capabilities to extend consistent, widespread coverage everywhere. If you don’t live in an urban area with mmWave, prepare to be disappointed in your 5G speeds. Carriers may ultimately regret the poor messaging.

Important Points to Consider

With 5G implementation underway by all major U.S. carriers, it has become more important than ever to understand how the wireless landscape will differ from prior generations. Given the momentous changes promised by 5G, businesses will need to closely monitor the latest trends and developments impacting communications and asset valuation.

For more information on how you can prepare for changes in 5G wireless communications, please contact Duff & Phelps Property Tax Services practice for more insights.

Sources

1https://www.tomsguide.com/us/ att-5g-network,news-29855.html

2Fierce Wireless, Marek’s Take: 5G is in its infancy, and consumers are already confused, Sue Marek, Dec. 9, 2019 (https://www.fiercewireless.com/5g/marek-s-take-5g-its-infancy-and-consumers-are-already-confused)

3Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2017–2022, February 2019, page 15.

4“Smarter and More Efficient: How America’s Wireless Industry Maximizes Its Spectrum.” CTIA, July 9, 2019

https://www.ctia.org/news/smarter-and-more-efficient- how-americas-wireless-industry-maximizes-its-spectrum

5Ibid.

6https://twitter.com/JohnLegere/status/1143512411720151040

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Kroll engages with companies nationwide to provide independent, innovative and results-driven property tax services.

by Cem Ozturk, Gary Gill, Sergio Revilla , Amanda Wood

by Alexander Weiterer, Jonathan Jacobs, Andreas Stoecklin, Rebecca Nelson, David Liu, Bob Bartell, CFA, Joanna Bartecki

by Umakanta Panigrahi, Aviral Jain, Sanjay Ray