In the 21st century, sustainability goals have reached the C-suite level. You will find a new clean energy or climate change goal on the books, in almost half (48%) of Fortune 500 companies. Cognizant of this trend, and to do its part, the Czech government has enacted a series of sustainability-related incentives, two of which we highlight in this article: one specifically related to photovoltaic (solar) systems and another generally aimed at energy efficiency.

Cash Grant for Photovoltaic Systems

This program supports the reduction of energy intensity of the business sector. The purpose of the program is to promote actions contributing to reduced end-use energy consumption.

Supported Activities

The primary activities supported under this grant include installation of photovoltaic systems for the use of the company. These systems may or may not include accumulation of energy.

Eligible Applicants

All enterprises regardless of size that have at least a two-year history may apply for this grant.

Supported Area

Investments in any part of the Czech Republic, other than the area of the Prague capital, are eligible. However, the company headquarters may be in Prague.

Funding Intensity and Amount of Subsidy

- Small enterprise – up to 80%

- Medium-sized enterprise – up to 70%

- Large enterprise – up to 60%

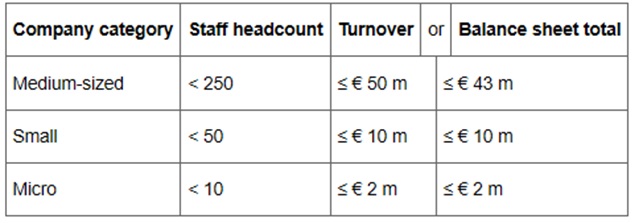

See chart below for definition of micro, small and medium-sized enterprises.

Funding will be granted in the form of cash grants, ranging from CZK 2 million – 50 million (mn) (USD 88 mn – USD 2.2 mn)

Eligible Costs

- Tangible fixed assets

- Intangible fixed assets (if required for operation of the tangible fixed assets)

Criteria

- The project has not started before the date of submission of the application.

- Export-related activities outside of the Czech Republic are not supported.

- The applicant must clearly demonstrate ownership or other rights to buildings and land plots, where the project will be implemented.

Time frame

Submission of applications:

January 13, 2020 through August 31, 2020

The project must be finished within three years of submission of project application or latest by March 31, 2023.

Cash Grants for Energy Efficiency

This cash grant program is focused on increasing the efficiency of energy consumption in the business sector. The purpose is to support actions contributing to the increased efficiency of total energy consumption, and therefore, is much broader than the photovoltaic grant opportunity described above.

Supported Activities

- Modernization of existing facilities, leading to an increase in efficiency

- Introduction and modernization of energy measurement and regulation systems

- Modernization and reconstruction of existing facilities for a company’s production of energy, leading to greater efficiency

- Modernization of lighting systems for buildings and industrial complexes (only replacement of obsolete technologies for new highly efficient lighting systems, for example LED)

- Increasing the efficiency of energy generation, transmission and consumption (energy savings)

- Improvements to the thermal-technical properties of buildings

- Utilization of waste energy in industrial processes

- Reduction of energy requirements/Increasing energy efficiency of production and technological processes

- Installation of renewable energy for company’s own consumption

- Installation of cogeneration unit using electricity and thermal energy for company consumption

Eligible Applicants

All enterprises regardless of size that have at least a two-year history may apply for this grant.

Funding Intensity and Amount of Subsidy

- Total grant budget is CZK 6 billion (USD 264 mn)

- Minimum amount of subsidy: CZK 500,000 (USD 22K)

- Maximum amount of subsidy: EUR 15,000,000 (USD 16.6 mn)

Small enterprise – 50%

Medium-sized enterprise – 40%

Large enterprise – 30%

See chart below for definition of micro, small and medium-sized enterprises.

Supported Area

Investments in any part of the Czech Republic, other than the area of the Prague capital, are eligible. However, the company headquarters may be in Prague.

Eligible Costs

- Long-term tangible and intangible assets

- Environmental studies

- Building inspector and technical supervision

- Project documentation

Criteria

- Eligibility of cost starts after the acceptance of the project by the Czech authorities.

- Export-related activities outside the Czech Republic are not supported.

Time frame

Submission of application deadline: April 30, 2020

The project must be completed by December 31, 2022.

Important Questions to Ask

When determining how best to meet a global sustainability goal, while still meeting internal ROI or payback period guidelines, the best approach is to analyze global energy consumption and associated costs. The focus must be first on jurisdictions of highest use and highest cost. Incentive benefits are a great tool for reducing costs but are dwarfed by the actual cost savings of moving to renewables in the long term.

That said, businesses that take advantage of these incentives will often be able to reduce the cost of doing business or drive more sustainability at the same cost. Working with an experienced tax, site selection and incentives team, to help you navigate working with the state administration, grant providers and tax authorities regarding the updated Czech calls for proposals, will provide an advantage by minimizing the time spent on the application process and ensuring all relevant funding sources are considered.

Definition of Micro, Small and Medium-Sized Enterprises in the European Union

In addition to gathering and presenting in this publication information from our own team of site selection and incentives advisors, we partnered with Varsha Ramlal, Funding and Innovation Consultant at The European Funding Alliance.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Site Selection and Incentives Advisory

Kroll has a proven track record of assisting companies with location strategies in the U.S. and around the globe.