Thu, Dec 6, 2012

Del-AWARE Update

In large part, due to the lobbying efforts of many corporations that are incorporated in Delaware, the State legislature and its Governor have created a meaningful opportunity for companies to voluntarily come forward and commence the reporting of unclaimed property without the fear of audit by the state or its third party contingent fee agents. Several questions have arisen from the initial legislation that was passed back on July 11, 2012 and in subsequent announcements. Below is a quick reference guide for those who are seeking clarification on the new developments in this area.

Why Delaware’s Unclaimed Property Rules Matter?

Virtually all companies that have transactions with third parties, including employees, vendors, agents and customers, have the potential to generate unclaimed property. Typically unclaimed property arises through un-cashed dividend, payroll or vendor checks; unapplied or un-reconciled credits; or rebates and unredeemed stored value and gift cards. Under the rules regulating the administration of unclaimed property remittances, the state of incorporation of the entity issuing the potentially reportable property stands second in line to receive unclaimed property if the owner’s address is unknown or if records do not exist to identify the owner. Since Delaware is the state of incorporation for the overwhelming majority of entities across the country (over 800,000 according to public records), the state stands to receive hundreds of millions in unclaimed property and has a rigorous audit program in place to ensure compliance with these rules. Many corporations, even those who genuinely believed they were in compliance with the existing laws, have had large multi-million settlements due to audits initiated by Delaware’s Department of Finance through third party contingent fee auditors engaged by the state.

What is the new Voluntary Disclosure Agreement Program?

The new Program includes several encouraging features, which any entity incorporated in Delaware that may not be in full compliance with the expansive unclaimed property provisions should take into consideration. These include:

- A one-time opportunity to avert audit, interest and penalties by coming forward on or before June 30, 2013 indicating a company’s intention to participate in the Program and then completing the report and submission on or before June 30, 2014.

- If this time line is satisfied, the State not only will waive interest and penalties but will also reduce the number of years subject to reporting by 15 years. (The voluntary submission includes years 1996 through 2012, if audited the period extends back to 1981).

- Entities that fail to meet the June 30, 2013 date can still participate in the Program, if entered into by June 30, 2014, but must complete the report and remit payment before June 30, 2015 in exchange for an increase in the look back period to 1993 (from 1996).

What’s different from the previous VDA programs?

The most significant change from the old Program is a stated intention by the Secretary of State to encourage companies to come forward in an effort to create more certainty about the process and result in a “more friendly and collaborative manner” than companies may previously have experienced when administered by the Department of Finance. The Secretary of State has also hired a law firm to help administer the program on an hourly versus contingent fee arrangement.

The Delaware Secretary of State asserts that the ultimate goal in executing the new program is to incentivize Delaware registered businesses that are not in full compliance to voluntarily come forward and gain compliance by participating in the VDA Program. The benefits of the Program are:

- Waiver of interest and penalties;

- Reduced look back to 1996 or 1993 (in lieu of the existing VDA reach back to 1991);

- A definitive review process promised to be less extensive that the current review process of 2 to 5 years; and

- The Secretary also points out that the entire process strives to foster collaboration between the holder and the State rather than the traditional adversarial relationship which has resulted in the conversion of VDAs into audits.

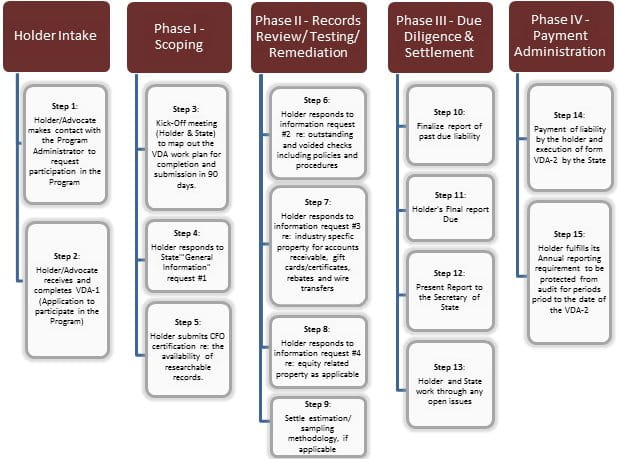

In order to demonstrate this more friendly relationship, the Secretary of State has established a website, which includes among other information, answers to frequently asked questions as well as a four phased process with specific steps required to complete the VDA submission. The steps are:

What’s to be Done Now?

Every corporation that is incorporated in Delaware that is not under audit should review its potentially reportable unclaimed property and assess whether or not entering into a VDA under the new guidelines is to their advantage. This includes companies that have either:

- Never filed unclaimed property reports in Delaware and/or other states,

- Have filed in one or more jurisdictions, but may not be in compliance in Delaware and

- Those that may have previously entered into VDA’s with one or more states in the past, including Delaware.

As previously noted ALL companies have some form of unclaimed property, and the list of potentially reportable property is growing each year. Only by reviewing past practices and historical books can a company determine whether these new procedures will benefit their organization. Most importantly, many who in the past have hesitated to voluntarily come forward, for fear doing so will result is a long and costly audit should reconsider their decisions and review whether the new VDA will help to reduce potential audit risk, liability and interest/penalties.

At Duff & Phelps we assist companies to ensure they are “meeting, but not exceeding” their unclaimed property reporting obligations.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.