Fri, Apr 9, 2021

Texas Winter Storm Damage: Property Tax Relief Qualifications

The economic damage from winter storm Uri is estimated to be in excess of $195 billion (bn), possibly as much as $295 bn. The storm caused unprecedent damage and business interruptions to virtually all 254 Texas counties. In addition to damage caused outside of commercial and residential properties, extensive insurance claims have been filed for water damage and flooding caused by interior water pipes bursting. If any of your property, real or personal, sustained damage due to the storm, there is a possibility of property tax relief.

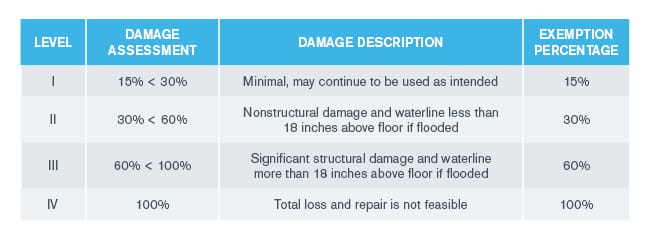

In response to the physical damage caused by Hurricane Harvey in 2017, the Texas Legislature enacted Section 11.35 of the Texas Property Tax Code. This law provides an exemption for all real property improvements and tangible personal property used in the production of income that is damaged by a disaster. In order to qualify, the property must have been damaged by at least 15%. Upon qualification, the property can receive a 15%–100% exemption, depending upon the level of damage. The exemption amount would be prorated from the date the governor declared the emergency, which in this case is February 12, 2021. In the declaration, all 254 Texas counties are eligible for property tax relief as a result of the damage from winter storm Uri.

In order to qualify for the exemption, an application with supporting data must be filed with the relevant appraisal district(s). The form requests the property owner to provide information regarding the extent of the damage, repair estimates and additional information that may be helpful in assessing the damage. The application must be filed no later than the 105th day after the date the governor declares the disaster area, or May 28, 2021. After filing, the appraisal district would determine if the damage is enough to warrant the exemption. The appraisal district has the right to request an inspection of the property.

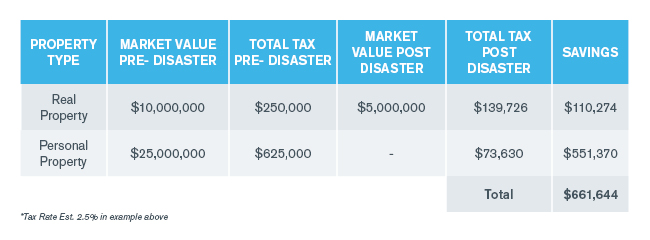

For example, a commercial manufacturing warehouse that houses production machinery and equipment along with stored raw materials and finished goods inventory was flooded due to a water pipe that burst within the facility. As a result of the flood, an insurance claim was filed. It was determined that several production machines and racks of inventory sustained total loss, and there was non-structural damage due to the waterline on the floor being less than 18 inches. The following assessment summarizes the property tax relief that could be available to the taxpayer if the appropriate valuation analysis is quantified and presented to the local tax assessor.

Complex analysis related to the valuation of the specific property damage will be necessary to maximize the amount of relief allowed by each taxing jurisdiction in Texas. The Property Tax team of Duff & Phelps, A Kroll Business, has expertise in quantifying the specific impacts to your property to maximize the benefits afforded to all taxpayers per Section 11.35 of the Texas Property Tax Code. If your property sustained any damage from winter storm Uri, please contact our experts to discuss possible qualifications and advisory for the exemption program.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Site Selection and Incentives Advisory

Kroll has a proven track record of assisting companies with location strategies in the U.S. and around the globe.