Tue, Nov 24, 2020

Chicago Companies vs. DJIA during COVID-19

As optimism pours through the financial markets with positive news about a potential COVID-19 vaccine, there is renewed enthusiasm about the recovery and performance of Chicago’s largest companies. Duff & Phelps created and analyzed a price-weighted index of Chicago’s 30 largest publicly traded companies by market capitalization (the CHI30). After initially underperforming the Dow Jones Industrial Average (the DJIA) during the COVID-19 pandemic, the CHI30 has surged since Q3 earnings were reported for September. Below are some key takeaways of our analysis comparing the CHI30 to the DJIA:

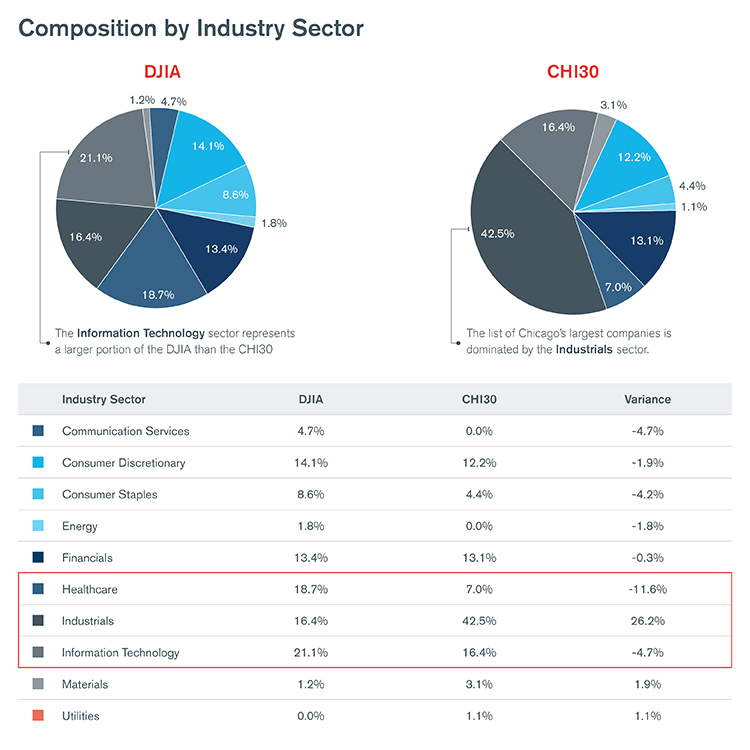

- The CHI30 is overweight in industrials and underweight in information technology, which led to the CHI30 not performing as well as the DJIA during the pandemic from February through September.

- Over the past two months, the CHI30 (▲8.9% since 9/17/20) has outperformed the DJIA (▲4.5% since 9/17/20) as small to mid-sized businesses, the clients of much of the CHI30, have begun to recover. The CHI30 has performed slightly better than the DJIA since the beginning of the year (▲2.6% vs. ▲2.2%).

- The CHI30’s financial performance during the 3rd quarter of 2020 has been comparable to that of the DJIA.

Given its position on Lake Michigan in the heart of Midwest manufacturing country, the CHI30 is overweight in industrials (42.5% of the total make-up) versus the DJIA (16.4%) and underweight in information technology (16.4%) versus the DJIA (21.1%). Boeing is included in both indices, but the CHI30 also contains United Airlines. The large reliance of companies in air travel with United (▼ 53.1% YTD) and Boeing (▼44.9% YTD) has made Chicago particularly vulnerable to the COVID-19 pandemic.

A notable difference between the CHI30 and the DJIA is the makeup of their information technology constituents. DJIA tech giants Salesforce (▲59.4% YTD), Apple (▲58.4% YTD), and Microsoft (▲38.5% YTD) led the market resurgence, as white-collar employees shifted to home offices and utilized additional tech hardware and services. These companies became essential parts of daily life and were able to thrive while much of the rest of the economy was experiencing significant stress. The CHI30 tech companies include CDW (▲0.8% YTD) and Zebra Technologies (▲38.1% YTD), providers of technology solutions to small to mid-sized businesses, many of which engaged in cost-cutting measures during Q2 2020. However, as small to mid-sized businesses have swallowed the initial shock of the pandemic, spending resumed on the fundamental IT systems and solutions that CDW and Zebra Technologies provide. Zebra Technologies beat Q3 2020 analyst estimates and improved revenue 18.4% from the prior quarter. CDW has benefitted from the rise of e-learning, resulting in customers in education bolstering their IT systems as net sales to their education clients increased 33.6% in Q3 2020 compared to the prior year. Since September 17, 2020, CDW’s stock has increased 26.0%.

Another bright spot for the CHI30 has been Deere (▲43.6% YTD). Record-high government payments to farmers are expected to lead to increased agricultural equipment purchases in 2021. Increased commodity prices have further boosted farmer balance sheets. Deere cut SG&A expenses in 2020 and is likely to maintain a low-cost base when sales increase in 2021.

The DJIA has experienced a couple of challenges over the past several months. IBM (▼13.8% YTD) has declined 7.5% since September 17 due to intense competition in cloud services and anticipated restructuring charges related to its planned spinoff of Managed Infrastructure Services. Intel (▼23.8% YTD) has declined 9.4% since September 17 due to gross margin challenges and lower than expected revenue from its Data Center Group.

Q2 2020 was the first full quarter to include the full impact of COVID-19. Q3 2020 represents a quarter in which businesses have learned to adjust to the new normal of the operating environment. The most drastic example is United, whose Q3 2020 revenue declined 80.8% compared to Q3 2019, but increased 91.2% compared to Q2 2020.

- The CHI30 has outperformed the DJIA in average Q3 2020 EBITDA margin compared to the prior year (▼4.7% vs. ▼5.3%) and average Q3 2020 EBITDA margin compared to the prior quarter (▲8.7% vs. ▼0.8%).

- The CHI30 underperformed the DJIA in average Q3 2020 revenue change compared to the prior year (▼3.3% vs. ▼2.3%), average Q3 2020 revenue change compared to the prior quarter (▲13.3% vs. ▲15.5%), average Q2 + Q3 2020 revenue change compared to the prior year (▼6.8% vs. ▼5.8%), and average Q2 + Q3 2020 EBITDA margin change compared to the prior year (▼7.7% vs. ▼7.5%).

Over the course of 2020, we have learned that the size and diversification of the DJIA makes it well-suited to handle turbulent market conditions. The DJIA is comprised of some of the largest companies in the entire country ($195 billion median market cap vs. $25 billion median market cap of CHI30) and is composed of diversified companies. The DJIA would be expected to outperform a subset of the country. Despite being comprised of smaller companies with less diversification, the CHI30 has outperformed the DJIA over the course of 2020 as small to mid-sized businesses are recovering.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Fairness and Solvency Opinions

Duff & Phelps Opinions is a global leader in Fairness Opinions and Special Committee Advisory, ranking #1 for total number of fairness opinions in the U.S., EMEA (Europe, the Middle East and Africa), Australia and Globally in 2023 according to LSEG (FKA Refinitiv).

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Private Capital Markets – Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.