Mon, Oct 1, 2018

Transfer Pricing Times: IRS and Treasury Propose Removal of Section 385 Documentation Regulations

In this edition: the IRS and Treasury filed a proposal to remove the regulations under Section 1.385-2; Treasury and the IRS issued proposed regulations under Section 951A of the Internal Revenue Code; the IRS released a draft Form 8991 to compute tax on Base Erosion payments; the OECD released the first public discussion draft on the transfer pricing of financial transactions; the OECD released updated Guidance on the Implementation of Country-by-Country Reporting under BEPS Action 13; Hong Kong activated bilateral exchange relationships with 36 countries for the exchange of Country-by-Country reports; and the ATO again took the opportunity to publicly deliver a number of key messages to taxpayers.

- IRS and Treasury Propose Removal of Section 385 Documentation Regulations

- Proposed GILTI Regulations Under Section 951A

- IRS Releases Draft Form 8991 to Compute Tax on Base Erosion Payments

- OECD Publishes Comments on Financial Transactions Discussion Draft

- OECD Releases Further Guidance on Country-by-Country Reporting

- Hong Kong Activates Exchange of Country-by-Country Report with 36 Countries Under OECD Framework

- New Key Messaging from the Australian Taxation Office

IRS and Treasury Propose Removal of Section 385 Documentation Regulations

On September 21, 2018, the Internal Revenue Service ("IRS”) and Treasury filed a proposal to remove the regulations under Section 1.385-2, which set forth minimum documentation requirements to be satisfied in order for certain instruments to be treated as indebtedness for federal tax purposes. As a result, taxpayers are relieved from these specific documentation requirements, which were set to go into effect next year. The regulations were to apply specifically to certain related-party debt transactions involving U.S. borrowers on or after January 1, 2019.

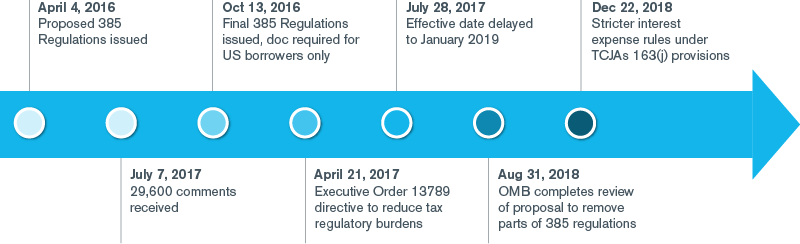

This proposal is the latest in a series of recent governmental actions taken to temper the 385 regulations since their introduction in April 2016, as highlighted in the diagram below.

As expected, the proposal suggests that the passage of the Tax Cut and Jobs Act ("TCJA”), specifically the revised 163(j) provision which caps interest expense deductibility for federal tax purposes, limits the benefits of minimum documentation requirements and influenced the decision to remove the regulations.

The IRS and Treasury explained that their decision came after careful consideration of public commentary received on these documentation regulations in connection with Executive Order 13789. According to the proposal, most commentary received from taxpayers advocated for either removal or modification of the regulations, and there was general consensus on the need for certain modifications, such as:

- The exclusion of transactions entered into in the ordinary course of business (e.g. trade payables);

- The use of “market standards” as the test for determining whether documentation requirements are satisfied; and

- Expansion of the rules to allow taxpayers to “cure or avoid noncompliance”.

The proposal also contains an analysis of the estimated impact of the removal of these regulations. Specifically:

- It was estimated that 6,300 taxpayers (which claim 65% of the interest deductions in U.S.) would be affected;

- Federal revenues would be reduced by $407 million for the period 2019-2028; and

- Compliance costs would be reduced by $924 million over the same period.

Despite their proposal to remove these documentation regulations, the IRS and Treasury indicated that they will continue to study the issues addressed by these rules, and they will maintain the possibility of proposing a “substantially simplified and streamlined” version of the regulations at a later date. If proposed, the IRS and Treasury have committed to an effective date that would allow sufficient time for taxpayers to comply.

The proposal was published in the Federal Register on September 24, 2018. To access a full copy of the proposal, click here.

Proposed GILTI Regulations Under Section 951A

On September 13, 2018, Treasury and the Internal Revenue Service (“IRS”) issued proposed regulations implementing Section 951A of the Internal Revenue Code. Section 951A was added to the Internal Revenue Code through the Tax Cuts and Jobs Act, which was signed into law on December 22, 2017. The proposed regulations provide taxpayers guidance related to the inclusion of Global Intangible Low-Taxed Income (“GILTI”) by U.S. shareholders.

The proposed regulations provide guidance on several issues, including, but not limited to, the following:

- The determination of pro-rata shares applicable to tested income or loss and to Qualified Business Asset Investment (QBAI) for purposes of determining GILTI;

- The calculation of tested income and loss;

- Rules regarding QBAI and specified tangible property (e.g., clarification that tested loss CFCs do not have specified tangible property);

- Tested interest expense and tested interest income;

- The treatment of domestic partnerships and their partners; and

- The treatment of the GILTI inclusion amount and adjustments to earnings and profits and basis.

The IRS states that GILTI is treated similarly to Subpart F income, with the primary difference being that GILTI is calculated on an aggregate basis. The U.S. shareholder aggregates its pro rata share of certain items (e.g., tested income, tested loss, or QBAI) into a single shareholder-level amount. The background discussion preceding the proposed regulations note that without this clarification, many taxpayers would be compelled to reorganize their ownership structures to obtain the full aggregation of CFC attributes for the GILTI calculations.

As the GILTI calculation includes a reduction of the GILTI inclusion by a tangible income return (i.e., 10 percent of QBAI), the proposed regulations include anti-abuse rules related to tangible assets and their use in reducing the GILTI inclusion. The proposed regulations discourage planning relying on reducing GILTI through asset basis step ups realized through reorganizations and temporary changes in asset ownership if those changes are determined to have been undertaken strictly for purposes of reducing tax under the GILTI rules.

The proposed regulations do not provide guidance under Section 951A on two key and interrelated taxpayer issues regarding GILTI. These two issues are: (1) the calculations for foreign tax credits, and (2) the related expense allocation for Section 904 limitation purposes. These issues are expected to be addressed in future guidance.

Before the proposed regulations are adopted as final regulations, Treasury and the IRS request written or electronic comments on all aspects of the proposed regulations to be submitted within 60 days after its publication.

The proposed GILTI regulations are available here.

IRS Releases Draft Form 8991 to Compute Tax on Base Erosion Payments

On September 20, 2018, the Internal Revenue Service (“IRS”) released a draft Form 8991 for taxpayers to compute their Base Erosion and Anti-Abuse Tax (“BEAT”) under Section 59A with Schedules A (Base Erosion Payments and Base Erosion Tax Benefits) and B (Credits Reducing Regular Tax Liability in Computing Base Erosion Minimum Tax Amount). At this point, the IRS has not released instructions for the Form. There has not been an indication from the IRS on when it will provide instructions.

Taxpayers and practitioners are welcomed to submit comments on the draft form.

OECD Publishes Comments on Financial Transactions Discussion Draft

On July 3, 2018, the Organisation of Economic Co-operation and Development (“OECD”) released the first public discussion draft on the transfer pricing of financial transactions. The discussion draft contains the first official detailed comments and guidance from the OECD on transfer pricing aspects of financial transactions. A summary of the discussion draft can be found in the July 2018 edition of Transfer Pricing Times.

Comments on the discussion draft were submitted to the OECD by September 7, 2018 and were subsequently made public on September 14, 2018. There were 78 submissions r of comments to the OECD, including a submission from Duff & Phelps, which can be found in Part II of the public comments. Duff & Phelps' comments on the discussion draft pertain to areas that it considers potentially problematic. Below is a summary of Duff & Phelps' response to the discussion draft:

First, with respect to the accurate delineation of transactions, we recommend that guidance avoid creating a framework for tax authorities to recharacterize loans simply because the issuance could be seen as relatively risky or speculative. We note that there exist many highly levered, unsecured, high yielding debt issuances in the market. As such, riskier characteristics (e.g., unsecured, subordinate) should not be a means for automatic recharacterization. Instead, as in market practice, risk should be assessed in the context of the lender’s availability of funds and appetite for the risk associated with the deployment of these funds and the borrower’s intent and ability to meet the debt obligations arising from such an issuance. Further, risk should be adequately reflected in arm’s-length compensation (e.g., interest).

Also, on this topic, we recognize the perceived merits of the OECD’s proposed approach of bifurcating intercompany financing instruments into part debt and part equity (as opposed to an “all-or-nothing” approach), but we also urge the OECD to consider the potential repercussions of loose guidance on this topic that may arise when countries attempt to implement it.

Second, with respect to risk free returns, we urge the OECD to reconsider and clarify its guidance with respect to situations in which it is found that a funder lacks the capability to perform decision-making functions and therefore cannot earn more than a risk-free rate as it applies to intercompany loans (and any return that a funder would earn in excess of the risk-free rate would be allocable to the entities that do perform decision making functions). Unlike prior guidance on Action Items 8 to 10 wherein the framework prescribed by the OECD removed potentially unlimited equity returns from what it called “cash boxes”, this guidance could remove fixed, contractual and readily benchmarkable returns from funding entities and overly compensate decision-making entities for what could be a relatively routine function in assessing and arranging lending opportunities. As such it is important that the OECD clarify this guidance in the context of intercompany loans, particularly with respect to defining decision making and control.

Finally, the Discussion Draft discusses the impact that the MNE group credit rating should have on the credit rating of a particular MNE within the MNE group. We have not opined on the appropriateness of considering the MNE group rating versus a stand-alone credit rating but recommend that the OECD’s final guidance have a more clearly defined and objective framework. Group and stand-alone credit ratings are often different from one another, which would likely lead economic analyses to result in different arm’s-length interest rates. As such, introducing these different approaches for determining a MNE’s credit rating and potential rebuttable presumptions could lead to double taxation risk if countries interpret and implement this guidance differently.

Additionally, Duff & Phelps hosted a webcast on the OECD discussion draft on September 19, 2018. A recording of the webcast and presentation materials can be found here.

OECD Releases Further Guidance on Country-by-Country Reporting

On September 13, 2018, the Organization for Economic Co-operation and Development (“OECD”) released updated Guidance on the Implementation of Country-by-Country (CbC) Reporting (“the Guidance”) under Base Erosion and Profit Shifting (BEPS) Action 13. The Guidance provides several new updates for tax authorities and taxpayers including:

- Section II: Issues Relating to the Definition of Items Reported in the Template for CbC Report

- The Guidance clarifies the treatment of dividends received in Table 1 of the CbC report.

- It also makes clear that shortened amounts should not be included in Table 1 of the CbC report.

- Section III: Issues Relating to the Entities to be Reported in the CbC Report

- The Guidance includes questions and answers on the treatment of major shareholdings in Table 1 of the CbC report.

- Section VI: Issues Relating to Mergers, Acquisitions, and Demergers

- The OECD has provided a table that summarizes existing interpretative guidance on the approach to be applied (within Table 1) in cases of mergers, demergers, and acquisitions.

The OECD notes that the Guidance on the Implementation of Country-by-Country Reporting will continue to be updated with any further guidance that may be agreed upon.

Hong Kong Activates Exchange of Country-by-Country Report with 36 Countries Under OECD Framework

In September 2018, the Organisation of Economic Co-operation and Development (“OECD”) updated the bilateral exchange relationships for the automatic exchange of Country-by-Country ("CbC”) reports. Through these updates, Hong Kong activated bilateral exchange relationships with 36 countries for the exchange of CbC reports.

Hong Kong’s exchange program, which will be undertaken in accordance with the Multilateral Competent Authority Agreement on the Exchange of Country-by-Country Reports, will be effective for taxable periods starting on or after January 1, 2019.

The list of all the activated exchange relationships for CbC reports can be found here.

New Key Messaging from the Australian Taxation Office

In August 2018, the Australian Taxation Office (“ATO”) again took the opportunity to publicly deliver a number of key messages to taxpayers. Deputy Commissioner Mark Konza spoke at the Australian Tax Institute’s 2018 National Transfer Pricing Conference and delivered messages in relation to the ATO’s transfer pricing practices and audit activity. In particular, Mr. Konza spoke about the ATO’s power to reconstruct non-arm’s length arrangements, the importance of addressing the allocation of risk under the updated OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (“OECD Guidelines”), and the key ATO focus areas in relation to its audit program.

Transfer Pricing Reconstruction Power

The Australian transfer pricing legislation provides the ATO with the power to reconstruct a non-arm’s length cross-border related party transaction to accord with how independent parties would have transacted and impose transfer pricing adjustments on that basis. The legislative provision arguably provides the ATO with a broader reconstruction power than that contemplated by the OECD Guidelines and this continues to be of concern to taxpayers. The ATO has previously stated that it would only exercise this power after several levels of internal review. Mr. Konza provided an example of when the ATO might exercise that power at the conference, saying:

For example, we may need to consider the substitution of arm’s length arrangements where an Australian entity seeks to transfer significant assets from Australia or allows the relative value of its Australian assets to erode in ways that independent entities acting commercially would not.

The ATO’s power to reconstruct arrangements continues to be an area of considerable uncertainty – and therefore concern – for multinational taxpayers.

Adopting the Revised OECD Guidelines

Mr. Konza confirmed that the revised OECD Guidelines (released in July 2017) have now been incorporated into Australian transfer pricing law. He emphasized that the allocation of risks in the revised OECD Guidelines will affect transfer pricing cases in Australia:

We have seen cases in the past where companies have argued that the profits from risk control functions undertaken in Australia should be recognized offshore due to a foreign role in setting a policy environment or formalizing a decision through a board meeting. Under the new commentary, it will be clearer that the outcomes of that entrepreneurial function are properly allocated in Australia.

Multinational taxpayers will clearly have to address the Organisation for Economic Co-operation and Development’s (“OECD”) allocation of risk principles in reviewing their Australian transfer pricing arrangements going forward.

Transfer Pricing Audits

Mr. Konza also discussed the ATO’s audit program, noting the ATO’s focus on the pharmaceutical industry. He indicated that there are currently nine transfer pricing audits underway in the industry along with nine advanced pricing arrangement applications in progress. Mr. Konza also emphasized that the ATO is continuing to look at the following hot topic areas:

- The energy and resource sector – particularly exploration expenditure;

- Hubs (particularly marketing hubs); and

- Related party financing such as debt financing, the use of derivatives to avoid interest withholding tax, and cross-country interest rate swaps.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.