Wed, Oct 14, 2020

Effect of New Lease Accounting Standards on Intercompany Loan Benchmarking

Companies commonly use leasing as a means of financing. The accounting for leases distinguishes between operating and finance leases. The International Accounting Standards Board (IASB) and the U.S. Financial Accounting Standards Board (FASB) issued new lease accounting standards (IFRS 16 and U.S. GAAP ASC 842) which require operating leases (excluding short-term and low value leases) that were previously recorded off the balance sheet to be recognized on the balance sheet and accounted for as a right-of-use (ROU) asset and a lease liability. All companies applying IFRS will be required to implement IFRS 16 for fiscal years beginning on or after January 1, 2019. Public companies applying U.S. GAAP will be required to implement ASC 842 for fiscal years beginning on or after December 15, 2018 (generally, calendar year 2019) and private companies applying U.S. GAAP will be required to implement ASC 842 for fiscal years beginning on or after December 15, 2019 (generally, calendar year 2020).

These new accounting standards were jointly developed by the IASB and FASB to enhance comparability between companies that account for similar lease transactions differently and between companies that lease assets versus those that buy assets financed with debt.

IFRS 16 (but not ASC 842) also requires that all leases be treated as finance leases from an income statement perspective such that the operating lease expense is now broken into interest expense on the lease liability and depreciation of the ROU asset.1 This has driven a decrease in the operating lease expense and increases in depreciation and finance costs under IFRS 16. This change has effects on certain financial metrics such as EBIT/EBITDA, operating cash flow, return on assets, leverage ratios and coverage ratios and affects analyses undertaken for benchmarking interest rates on intercompany loans.

Consequently, companies with leasing activities will need to assess the potential impact of the changes for the 2019 calendar year and beyond and if necessary, make appropriate adjustments to their benchmarking to account for the new accounting treatment.

This article examines the ramifications for intercompany loan benchmarking in a transfer pricing context; in particular, the impact on credit ratings and debt capacity analyses.

Impact on Credit Rating

The creditworthiness of the borrower is a key determinant of the pricing of debt funding. Commercial lenders and credit rating agencies consider a number of financial metrics in credit scoring companies, including measures of operating profitability, interest coverage, leverage and gearing (i.e., gross debt divided by equity). Credit rating agencies such as S&P and Moody’s view no distinction between operating and finance leases for rating purposes and make adjustments to bring operating leases onto the balance sheet and added to debt by an amount equal to the present value of future lease payments. This balance sheet treatment generally aligns with both IFRS 16 and ASC 842. The operating lease expense is apportioned to interest and depreciation components, which also aligns with the new IFRS standard (but not U.S. GAAP).

The new lease accounting standards have brought financial reporting closer to credit rating agencies’ treatment of operating lease liabilities and therefore should not have any material impact on credit ratings in theory. As a practical matter, however, applying these adjustments may not have been that straightforward for transfer pricing practitioners using credit scoring tools or rating methodologies to assess creditworthiness. Historical data challenges in estimating the lease liability and apportioning operating lease expenses to interest and depreciation should be alleviated now because the new reporting will reflect a more precise calculation of the company's lease obligations and associated interest and depreciation expenses, especially for companies reporting under IFRS.

Impact on Debt Capacity

Establishing the interest rate for an intercompany loan often entails evaluating a supportable level of debt for which a debt capacity analysis is commonly performed. This may involve a consideration of the entity’s ability to service its debt as measured by the debt-to-equity ratio and covenant ratios such as leverage and interest coverage.

The increase in liabilities and EBITDA/EBIT under the new accounting principles means that debt covenants could be impacted for many borrowers. Though the FASB has stated that ASC 842 characterizes operating lease liabilities as operating liabilities rather than debt and therefore should not significantly affect debt covenants, operating lease liabilities may be considered debt under IFRS 16 and so could directly affect debt covenant ratios. Nevertheless, a question remains regarding how commercial lenders view those liabilities. If lenders view lease liabilities as debt, this could directly affect debt covenant tests in existing loan agreements depending on the definition of the debt covenants and whether the terms of the debt facility provide protection against changes in financial ratios due to change in accounting standards (so called “frozen GAAP” or “frozen IFRS” clauses). Going forward, the impact will depend on the propensity of lenders to reset financial covenants to reflect current accounting principles.

The following example illustrates the impact of IFRS 16 on key financial ratios typically associated with loan covenants assuming the following balance sheet and income statement items:

| Profit and Loss Statement ($’000) | Pre IFRS 16 | Post IFRS 16 |

| Revenue | 550,000 | 555,000 |

| Operating lease expense | (8,500) | – |

| Other operating expenses | (333,500) | (333,500) |

| EBITDA | 208,000 | 216,500 |

| Depreciation expense on ROU assets | – | (7,000) |

| Other depreciation | (107,000) | (107,000) |

| EBIT | 101,000 | 102,500 |

| Interest expense on lease liabilities | – | (1,500) |

| Other interest expense | (46,000) | (46,000) |

| Profit before tax | 55,000 | 55,000 |

| Balance Sheet ($’000) | Pre IFRS 16 | Post IFRS 16 |

| Cash | 200,000 | 200,000 |

| Right of use assets | – | 50,000 |

| Intangible assets | 10,000 | 10,000 |

| Other assets | 800,000 | 800,000 |

| Total assets | 1,010,000 | 1,060,000 |

| Gross debt | (550,000) | (550,000) |

| Lease liabilities | – | (50,000) |

| Other liabilities | (100,000) | (100,000) |

| Total liabilities | (650,000) | (700,000) |

| Net assets / equity | 360,000 | 360,000 |

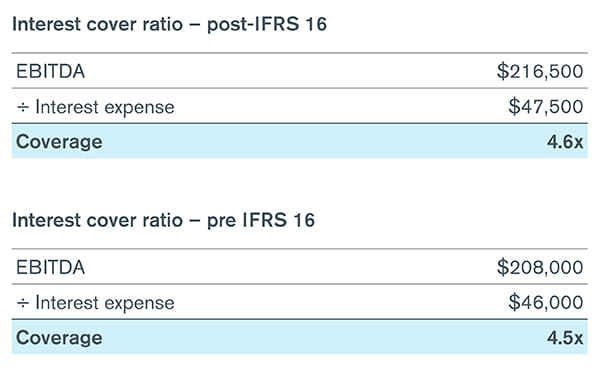

The interest cover ratio (pre- and post-IFRS 16) is calculated as follows:

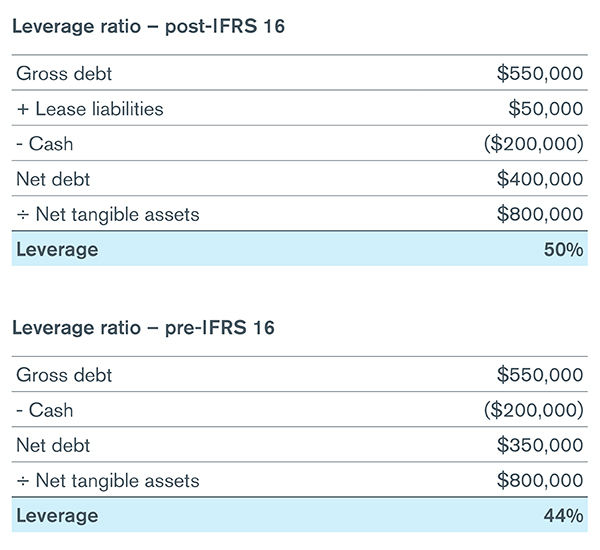

The leverage ratio (pre- and post- IFRS 16) is calculated as follows:

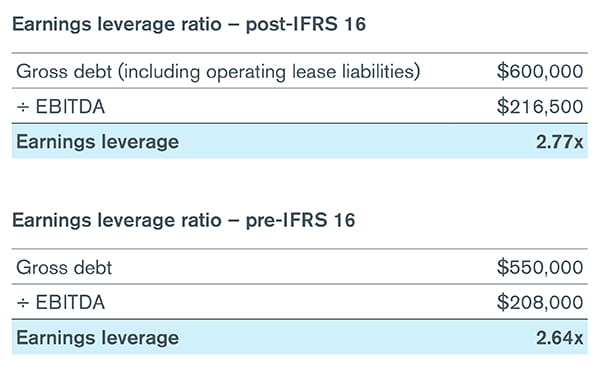

The earnings leverage ratio (pre- and post-IFRS 16) is calculated as follows:

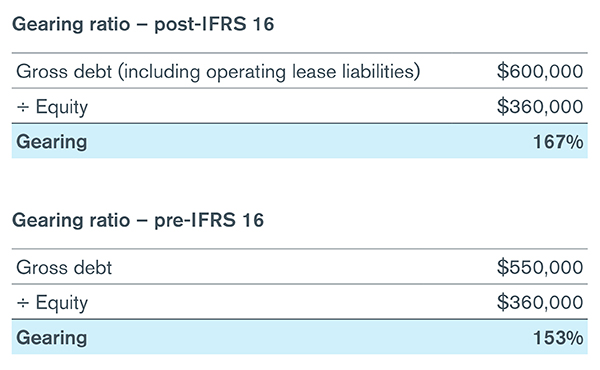

The gearing ratio (pre-and post-IFRS 16) is calculated as follows:

As can be seen from the above, the effect of IFRS 16 is to increase the debt amount and EBITDA by the implicit interest and depreciation portions. The higher EBITDA under the new accounting standards would have a positive (albeit modest) impact on the interest cover ratio while the higher liability amount would have a negative impact on the leverage ratios and gearing ratio. The net effect is to place negative pressure on a company’s borrowing capacity where the percentage increase in debt exceeds the percentage increase in EBITDA. The magnitude of the impact will depend on the portion of total debt comprised of operating lease liabilities.

The effects on financial ratios will have transitional impacts for taxpayers that use pre-2019 calendar year financial statements of comparable companies to benchmark financial metrics. These taxpayers will need to ensure that appropriate adjustments are made to avoid any distortions in the data and increase the reliability of the analysis.

Taxpayers that rely on safe harbor methods under local thin capitalization rules will need to consider the impact of the recognition of additional assets and lease liabilities on thin capitalization calculations and in turn interest deductibility.

In summary, common financial metrics used to evaluate creditworthiness and debt capacity of companies may be significantly impacted by the new lease accounting standards. Although existing approaches to estimating credit ratings are generally not affected by the change, the enhanced transparency under the new reporting means that credit rating agency adjustment procedures should be easier to implement. Furthermore, borrowers under related party debt arrangements may need to factor the amount of additional indebtedness resulting from the new lease accounting rules into their facility limits. This could affect existing and future transfer pricing policies and decisions concerning intercompany funding.

Read Transfer Pricing Times – Third Quarter 2020

Sources

1.By contrast, ASC 842 did not revise the classification of operating lease expense on the income statement and continues to distinguish between finance leases and operating leases. As a result, there is not full comparability between companies that report under IFRS and US GAAP.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.