Tue, Feb 19, 2019

U.S. Equity Risk Premium Recommendation

Read Valuation Insights, First Quarter 2019

The Equity Risk Premium (“ERP”) is a key input used to calculate the cost of capital within the context of the Capital Asset Pricing Model (“CAPM”) and other models. There is ample academic evidence that the ERP is not constant over time. Fluctuations in global economic and financial conditions warrant periodic reassessments of the selected ERP and accompanying risk-free rate.

Based upon current market conditions, Duff & Phelps is increasing its U.S. Equity Risk Premium recommendation from 5.0% to 5.5%. The 5.5% ERP guidance is to be used in conjunction with a normalized risk-free rate of 3.5% when developing discount rates as of December 31, 2018 and thereafter, until further guidance is issued.

Duff & Phelps last changed its U.S. ERP recommendation on September 5, 2017. On that date, our recommendation was decreased to 5.0% (from 5.5%) in response to evidence in late 2016 and early to mid-2017 that suggested a subdued level of risk in financial markets. Back then, strong earnings growth, still-accommodative monetary policies, and benign global macroeconomic trends buoyed U.S. stocks. Corporate earnings had surpassed expectations, fueling hopes for even higher dividend payouts and stock buybacks. Investors’ perception of negligible levels of risk was manifested through record-low levels of equity volatility (as measured by the VIX index) and a sharp narrowing of corporate credit spreads.

The optimism in equity markets persisted into late 2017 and early 2018, after the passage into law of the largest U.S. corporate tax reform in over 30 years. The Tax Cuts and Jobs Act, enacted on December 22, 2017, cut both personal income tax rates (temporarily through 2025) and the statutory corporate tax rate from 35% to 21% (permanently), among many other provisions. While not all industries were anticipated to be net beneficiaries from the U.S. tax reform, investors appeared to be expecting on average a substantial increase in after-tax corporate earnings, which spurred further stock market records. Despite a temporary spike in volatility in February 2018 – partly fueled by concerns that a rise in inflation could lead to an acceleration in interest rate hikes – U.S. equity markets quickly bounced back, reaching new record highs in September 2018.

From October through December 2018, the picture that emerged was very different: U.S. stock prices suffered significant losses, with an accompanying surge in equity volatility and a widening of corporate credit spreads. Broad U.S. stock market indices ended 2018 with negative total returns, the worst performance since 2008 at the sentiment appears to be primarily attributable to the perceived fast pace in monetary policy tightening by the Federal Reserve, signs that global economic growth may be decelerating (particularly in China), and trade disputes between the U.S. and China. The unknown outcome of Brexit negotiations, and other geo-political risks appeared to add to the uncertainty. The fact that U.S. macroeconomic trends are still very positive, with strong U.S. real GDP growth and historically low unemployment levels, was insufficient to offset the rise in investors’ risk aversion.

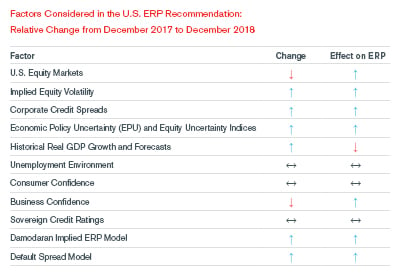

Duff & Phelps goes beyond historical measures of ERP by examining approaches that are sensitive to the current economic and financial market conditions. In the following table, we list the primary factors considered when arriving at the Duff & Phelps recommended U.S. ERP. We document the evolution of these factors from December 31, 2017 through December 31, 2018, along with the corresponding relative impact on ERP indications.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.