Thu, Aug 16, 2018

AICPA Accounting and Valuation Guide

Read Valuation Insights, Third Quarter 2018

Background

In May 2018, the American Institute of Certified Public Accountants (AICPA) released a working draft of an Accounting and Valuation Guide, titled “Valuation of Portfolio Company Investments of Venture Capital and Private Equity Funds and Other Investment Companies” (the Guide). The Guide has been under development for the past five plus years. The purpose of the Guide is to help harmonize the diverse views of alternative investment industry participants, auditors, and valuation experts and to create a user-friendly treatise with case studies that can be used to reason through the valuation judgements faced by investment fund managers, valuation experts, and auditors on a regular basis.

Contents and Potential Impact of the Guide

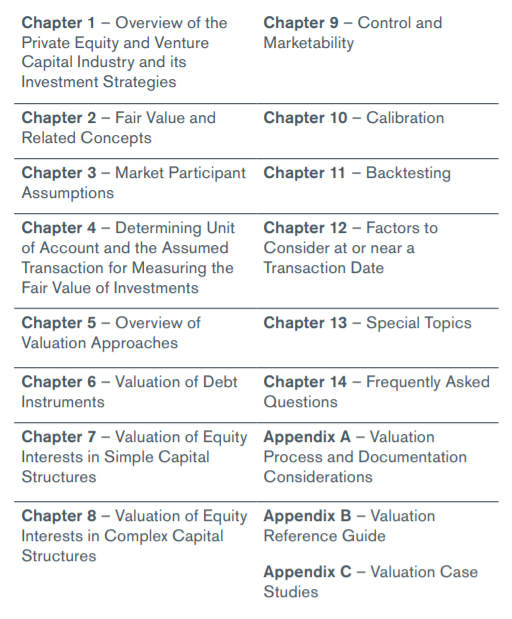

The Guide is extensive (almost 600 pages) and is example rich. Content is as follows:

As the Guide does not promulgate new Accounting Principles (that is the purview of FASB), there is no transition date.

If an investment manager’s valuation process is currently robust, using market participant assumptions, often augmented by a qualified, experienced, independent valuation expert, there may be limited impact from the Guide. However, for many applying the Guide could result in enhancements to their valuation process, including but not limited to:

- Nature of the hypothetical transaction at the measurement date

- Re-assessment of unit of account and allocation of value between securities

- Valuing investments with Level II inputs

- Less emphasis on Option Pricing Models (OPM) (no requirement to use OPM); the need to augment OPM or adjust OPM if used

- Treatment of transaction costs at entry and exit

- The need to calibrate valuation inputs

- Application of backtesting

- Use of premia and discounts

Scope and Application

While the Guide is non-authoritative, its application will be considered best practice given its thorough vetting by the AICPA, major accounting firms, and others. It provides illustrations for preparers of financial statements, independent auditors, and valuation experts regarding the valuation of portfolio company investments held by investment companies within the scope of FASB ASC 946 (including private equity funds, venture capital funds, hedge funds, and business development companies). The Guide will also be useful for non-investment companies, such as corporate venture capital groups or pension funds, which make investments in similar types of portfolio companies and pursue similar strategies when applying the fair value requirements of ASU 2016-01 and ASU 2018-03. In addition, the guide will be helpful when measuring the fair value of equity and debt investments in accordance with IFRS 9. However, it should be noted that the numerous and varied aspects of these non-investment entities were not considered or contemplated in the preparation of the Guide.

Feedback Requested

The AICPA has requested feedback on the working draft. All comments will be kept confidential and will not be posted on the AICPA Web site. If you would like to provide comments, please e-mail them to Yelena Mishkevich at [email protected].

Conclusion

Fair value accounting, especially for investment managers, is here to stay. The Guide provides best practice guidance so managers, investors, regulators, auditors and independent valuation experts can emphasize judgment in evaluating relevant factors, consistent with market participant assumptions.

For more information contact David Larsen, +1 415 693 5330; [email protected].

David Larsen, CPA/CEIV/ABV is a managing director with Duff & Phelps and serves as an advisor to IPEV Board, a member of the AICPA PE/VC Valuation guide taskforce, and former member of FASB’s Valuation Resource Group.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.