Thu, Aug 16, 2018

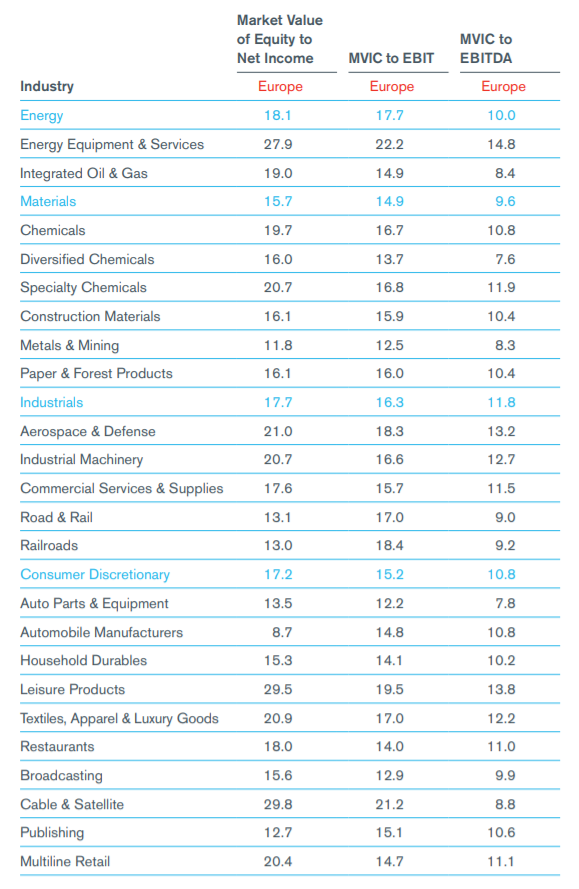

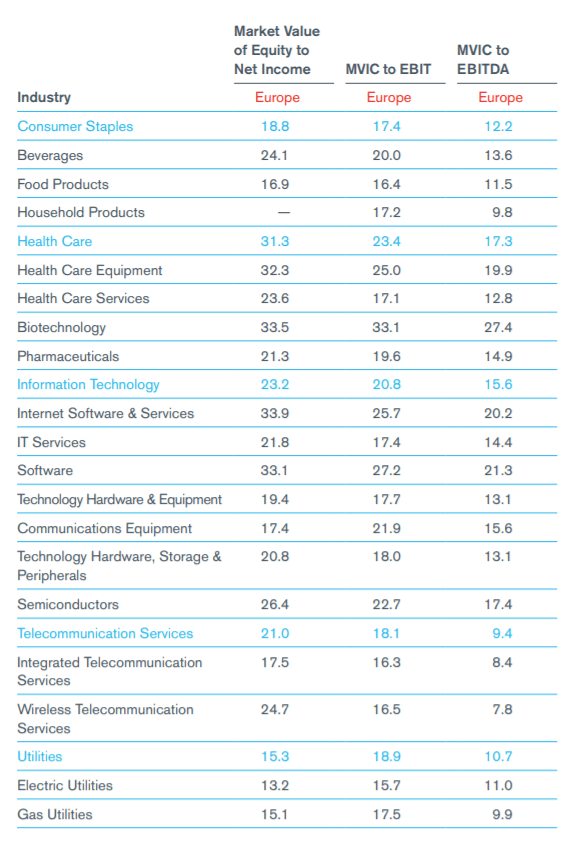

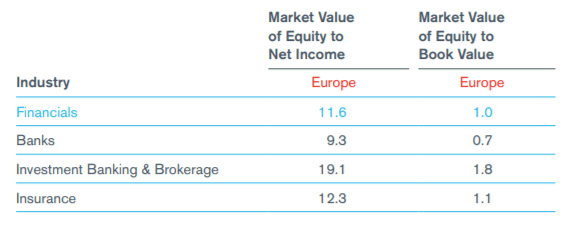

European Industry Market Multiples

Read Valuation Insights, Third Quarter 2018

Industry Market Multiples are available online! Visit www.duffandphelps.com/multiples

As of June 30, 2018

An industry must have a minimum of five company participants to be calculated. For all reported multiples in Europe, the average number of companies in the calculation sample was 91 and the median number of companies in the calculation sample was 38. Sample set includes publicly-traded companies (private companies are not included). Source: Data derived from Standard & Poor’s Capital IQ databases. Reported multiples are median ratios (excluding negatives or certain outliers). MVIC = Market Value of Invested Capital = Market Value of Equity plus Book Value of Debt. EBIT = Earnings Before Interest and Taxes for latest 12 months. EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization for latest 12 months. Note that due to the exclusion of negative multiples from the analysis, the number of companies used in the computation of each of the three reported multiples across the same industry may differ, which may occasionally result in a counterintuitive relationship between those multiples (e.g. the MVIC-to-EBITDA multiple may exceed MVIC to EBIT).

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.