Wed, May 22, 2019

Are Football Stadium Naming Rights Undervalued? A Comparison Between the UK and U.S.

Download the ReportDespite Premier League sponsorship deal values increasing exponentially over time, it still seems that stadium naming rights are a significantly underutilized revenue stream for clubs. In the Premier League, only 30 percent of teams have a stadium name sponsor compared to over 80 percent in the National Football League (NFL). Of the six teams that have a deal, namely AFC Bournemouth, Arsenal, Brighton & Hove Albion, Huddersfield Town, Leicester City and Manchester City, only Bournemouth and Huddersfield have stadium sponsors that are independent of their shirt sponsor and owner.

Football is undoubtably the world’s most popular sport, with broadcasting rights in 212 territories across the world and over 5 billion people tuning into a live football match at least once per season. 1.12 billion people watched the World Cup Final in 2018, the most ever recorded, compared to only 100.7 million people for the Super Bowl in 2019, the lowest in a decade. However, despite what may appear to be waning popularity, the NFL generated an average revenue of £310 million per team, the highest per team of any sport, which is higher than the Premier League’s average revenue of £238 million per team.

A significant reason for the stark difference between the revenue generated by these two football leagues is that the NFL has a monopoly over American football broadcasting, with annual revenues totaling c. £6 billion in 2018. For comparison, this dwarfs the Canadian Football League more than thirty times over. As a result, each NFL team receives £193 million per season from broadcasting rights. In comparison, total football revenues are shared amongst multiple leagues, both international and domestic, with the Premier League generating c.£2.4 billion of television revenue from Sky Sports, BT Sport and other agreements in 2018. Each Premier League team on average earned £121 million, with Manchester United topping the list at £149.8 million relegating West Bromwich Albion to last place with a modest £94.7 million. The Premier League is by far football’s most popular league with Spain’s La Liga and Germany’s Bundesliga generating almost £2.4 billion from broadcasting between them.

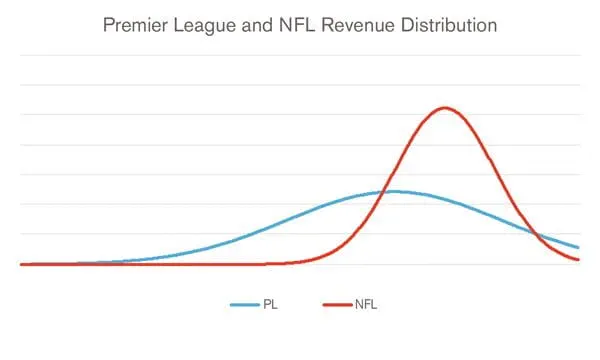

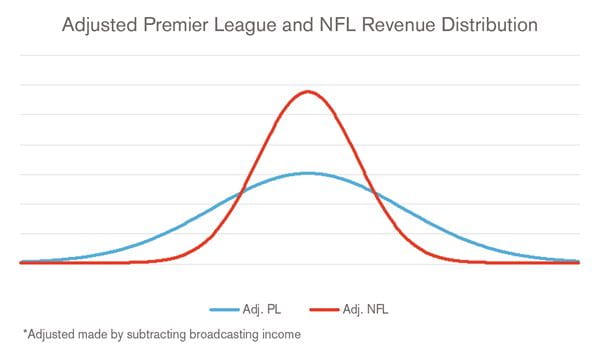

Income from stadium naming rights is a key factor contributing to the revenue differential with the NFL. Twenty-six of the thirty-two teams in the NFL have a stadium naming rights deal with an average value of £6.0 million per season. It may appear that NFL teams are not directly comparable to Premier League teams since NFL average revenues of £310 million are much higher than the Premier League’s average of £238 million. However, after deducting each teams’ broadcasting revenues this variance changes significantly. After this adjustment, Premier League average revenue is now equal to that of the NFL at £117 million.

In addition, the average revenues for the Premier League ‘Big 6’ are over 3.5x that of the bottom six. This differential is far more substantial than the NFL’s equivalent measure of 1.6x. These metrics illustrate the greater marketability the top Premier League teams have over their opponents at the bottom of the division. In fact, the Premier League ‘Big 6’ have broadcast adjusted revenue closely comparable with the NFL ‘Top 6’ teams with Manchester United second only to NFL revenue leaders the Dallas Cowboys. Also, the average ‘Big 6’ social media following measures 55.0 million compared to the NFL’s ‘Top 6’ average of 9.1 million, suggesting greater popularity. It would therefore be reasonable to assume that the Premier League ‘Big 6’ could command stadium naming rights revenues at least as high as their NFL counterparts. The average stadium naming rights value for the ‘Top 6’ NFL teams by revenue is worth £8.9 million per season with the most valuable naming rights agreement between the Dallas Cowboys and AT&T worth £14.3 million per season. Dallas’ deal was signed in 2013, so if renegotiated today this agreement would be worth significantly more.

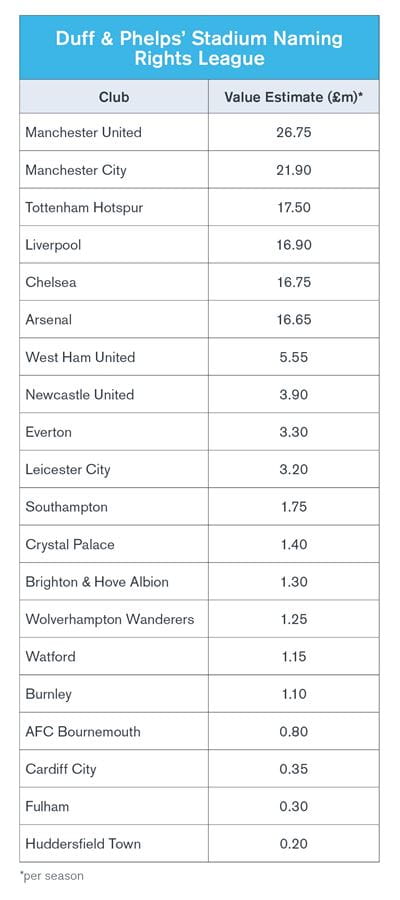

Against this backdrop, Duff & Phelps has estimated the value of Premier League stadium naming rights.

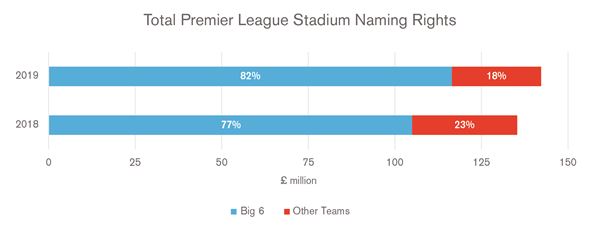

Manchester United, Manchester City, Tottenham Hotspur, Liverpool, Chelsea and Arsenal have further cemented their dominance with 82 percent of total value attributable to the ‘Big 6’. This is a 5 percentage point increase from 77 percent last year. Duff & Phelps’ estimate of total naming rights value has risen 5 percent to reach £142.0 million from £135.5 million in 2018.

Manchester United’s Old Trafford stadium remains the most valuable naming rights proposition with a value of £26.75 million per season. Second place Manchester City have closed the gap to less than £5 million from c.£7 million in 2018. However, the biggest gainers are Liverpool, whose naming rights estimate has risen over 50 percent to £16.90 million assisted by their Champions League final efforts last season and strong league performance this season. Whilst Liverpool does offer huge marketing potential, it is unlikely that a brand will enter the market in its infancy to change the name of the historic Anfield Stadium after observing the backlash from Newcastle fans when St James’ Park was changed to the Sports Direct Arena. Tottenham Hotspur’s Champions League hopes provide a further premium to be paid by a brand wanting to have their name on arguably the best stadium in Europe. There is also less risk of fan backlash and negative publicity as any potential deal would not involve changing the name of a historic stadium that is sentimental to fans. Huddersfield’s confirmed relegation has caused their future naming rights to fall by more than 30 percent whilst Wolverhampton Wanderers impressive performances this season have proved valuable.

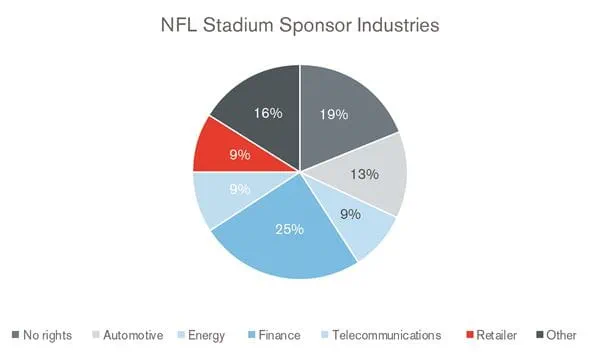

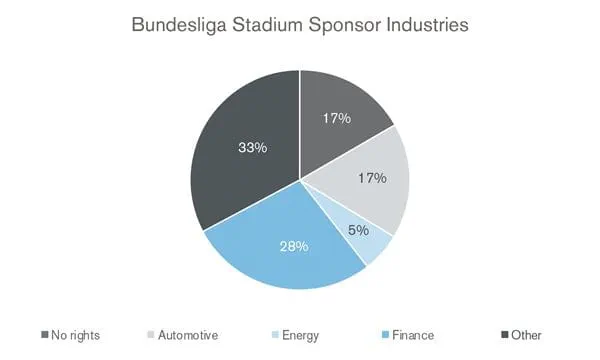

To understand which businesses would likely be interested in Premier League stadium sponsorship, Duff & Phelps has analyzed the sponsors of both the NFL and Germany’s Bundesliga, Europe’s most mature football stadium naming rights market, with over 80 percent of stadiums sponsored.

The Bundesliga sponsors show a more concentrated pool of industries compared to the NFL, with no telecommunications providers or retailers represented. The largest single sponsor of each league comes from the finance industry which sponsors c. 25 percent of named stadiums in both leagues. A key reason for this is that in the majority of cases, financial institutions aren’t simply buying the right to promote their name on the stadium but also to become a financial partner with the team. They use this partnership to sell other services to the club such as forecasting, player and stadium financing as well as selling credit and debit cards to supporters.

Allianz, the financial services company, has benefited from committing to stadium sponsorship and currently has naming rights agreements with seven sports stadiums including Bayern Munich (c. £5.2 million per season signed in 2002) and Juventus (c. £10.7 million per season signed in 2017). Each deal has proven to be positive for Allianz with the initial twenty year Bayern deal shielding them from any naming rights inflation and the Juventus deal affording them extra exposure due to the team’s acquisition of Cristiano Ronaldo who has more than 360 million social media followers.

Premier League clubs could also look at retailers, for instance the NFL’s San Francisco 49ers and Buffalo Bills have Levi’s and New Era as their stadium sponsors. The majority of value for a retailer sponsoring a team does not come through direct sales from the clubs’ store or from indirect sales from that association but actually through a relationship with the players. The influencer marketing industry is expected to reach c. £7.5 billion in 2020 with 67 percent of marketers planning to increase their influencer budgets over the next twelve months. Brands could save significant sums of money if they can negotiate access to the clubs’ and players’ social media platforms, some of the most followed in the world. Not only would a brand have direct access to millions of potential consumers, but they could also get exposure to jurisdictions which may have previously been hard to access. For example, Paul Pogba has 48 million social media followers with a European concentration, whilst Mohamed Salah’s 44 million offers a brand exposure outside of Europe. Premier League clubs may also prefer a retail sponsor compared to a significant corporate or banking sponsor because they may not want to appear to have changed the name of a historic stadium to a brand that supporters are not familiar with.

In summary, there is significant potential for all Premier League teams to gain valuable stadium naming rights sponsorship, with the most valuable and long-term deals reserved for those with the highest levels of global exposure, Champions League participation and low relegation risk. All Premier League teams benefit from being televised around the world on a regular basis with the U.S. alone showing all ten games each week, which means even the small teams and their eventual naming rights sponsors will benefit from global exposure to new and existing customers.

Michael Weaver, Managing Director at Duff & Phelps and Head of EMEA Valuation Advisory said: “Multimillion-pound Premier League shirt sponsorships have been signed, multimillion-pound sleeve sponsorships are being signed, and it is only a matter of time until multimillion-pound stadium sponsorships follow. Brands just have to be courageous enough to take the first step which will bring the market alive.

Few would have expected the level of growth we have seen in shirt sponsorship deals, which is why there is a huge opportunity for sponsors to capture value in the stadium naming rights market in Europe. If a sponsor were to take out a long-term, fixed value naming rights contract with a good team this could shield them from paying significantly higher prices in the future as the market matures. An example of this can be seen with the NFL’s Los Angeles Chargers and Buffalo Bills. LA’s twenty year 1997 agreement was worth less than $1 million per season whilst Buffalo’s more recent 2016 agreement is worth $5 million per season. This has proven to be value accretive for the LA franchise.”

Notes to Editors

This research was conducted in Q1 2019. The valuation metrics include publicly available information on shirt sponsor and technical partner values, social media followers, television rights and current naming values in addition to team performance over the past three seasons to calculate Premier League naming rights valuations.

Limitations of the Study

The analysis and estimates presented in this study are based on extensive research on publicly available secondary sources of information. We have not undertaken any independent verification or carried out any due diligence on the data used or considered, nor have we verified its factual accuracy in the current context.

The conclusions provided in this study shall not be construed as marketing advice and the valuations provided in the study shall not be used for any other purpose other than general research and media consumption. Duff & Phelps and its affiliates expressly disclaim all liability for any loss or damage of whatever kind which may arise from any person acting on any information and opinions or analyses relating to the valuations contained in this study.

The valuation of intangible assets is not a precise science and the conclusions arrived at in many cases will of necessity be subjective and dependent on the exercise of individual judgment. There is therefore no indisputable single value and we normally express our opinion on the value as falling within a likely range. Others may place a different value on the various rights.

All trademarks, trade names, or logos referenced herein are the property of the respective companies and owners.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.