Property Tax Services

Explore Tax Services

Duff & Phelps acquired Kroll in 2018 and unified under the Kroll brand in 2022.

Property taxes are one of the largest recurring operating expenses associated with tangible asset ownership. Owners are often unaware of what items or costs are taxable, what items are being assessed or how their property is being valued. Answering these and other related questions often produce recurring property tax savings for owners and lessees.

We assist clients in identifying tax saving opportunities by reviewing their tangible property portfolio and associated property tax assessments and liabilities. Through our diligence, we generate millions of dollars in property tax savings for clients worldwide.

Property Tax Advisory Services

Kroll has been successful in value negotiation and appeals, resulting in appropriate and uniform fair market values, and associated liabilities for clients we have represented in the most efficient, collaborative and high-quality manner. Our services include:

- Real and personal property tax appeal preparation

- Property tax audit support services

- Property tax consulting and support services in the form of equalization and obsolescence studies, cost of capital analyses, and property valuation and classification for real estate transfer tax planning

Property Tax Compliance and Co-Sourcing Services

The Kroll Property Tax Compliance team has proven successful over many years in ensuring timely and accurate submission of renditions and payment of the tax liabilities owed for the portfolios we have represented. Our services include:

- Fixed asset review categorization and identification of exempt items

- Personal property tax rendition preparation, filing and follow-up for locally and centrally assessed properties

- Real estate compliance filings

- Real and personal property tax assessment review

- Real and personal property tax bill accuracy review and vouchering

Property Tax Exemption and Abatement Services

Kroll ensures that all available statutory property tax exemptions and abatements are maximized in the value negotiations cycle. Our services include:

- Pollution control analyses for property tax exemption and special tax purposes

- Alternative energy exemption certification efforts

- Freeport exemption efforts

Property Tax Due Diligence Services

Kroll has successfully analyzed potential property tax liability considerations for both greenfield projects and operating projects, to ensure transaction prices realistically incorporate future operating costs related to tax. Our services include:

- Determine the impact the potential sale price may have on future property tax liability

- Utilize current assessor relationships to determine assessment of project

- Address opportunities for property tax abatement available for the project

Property Tax Expert Witness and Litigation Support Services

Kroll provides Property Tax Expert Witness and Litigation Support Services that are unmatched in the professional services industry due to our extensive work with numerous industries and asset types. Our services include:

- Rebuttal testimony / counsel preparation

- Work with legal counsel on case preparation

- Expert witness / testimony services

Connect with us

Sales and Use Tax Services

Kroll provides a comprehensive suite of sales and use tax services to assist companies in complying with its sales and use tax obligations.

Site Selection and Incentives Advisory

Kroll has a proven track record of assisting companies with location strategies in the U.S. and around the globe.

Webinar Replay – 2024 Property Tax Savings Through Co-Sourcing

Webinar Replay – 2024 Property Tax Savings Through Co-Sourcing

Kroll’s property tax experts discussed Kroll Tax Service’s property tax co-sourcing abilities.

Property Tax

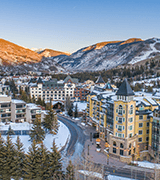

Colorado Supreme Court Rules Against the Inclusion of Rental Management Income

by Bruce Cartwright

Property Tax

Property Tax Snapshot: Mechanics and Trends

Valuation

Valuation Insights - First Quarter 2022

Valuation Outlook

2021 U.S. Goodwill Impairment Study