LIBOR Update

LIBOR Transition Advisory Newsletter - May 2022

by Mark Turner, Jeffrey Fromer

Successfully navigate the LIBOR transition with the leadership and experience of Kroll to synchronize effort across your entire organization.

Download the LIBOR Transition Toolkit to help gather the documentation needed to assess your LIBOR-linked exposure.

Our global team brings diverse expertise to efficiently handle the multitude of LIBOR transition tasks.

With LIBOR set to be decommissioned at the end of 2021, it is crucial to identify and replace references and dependencies. Kroll offers a unique skillset that allows us to assist clients in the LIBOR transition, end-to-end. From documentation review to financial modeling, Kroll can serve as your single source provider for LIBOR transition advisory services.

Many projects that fail, even with stellar project managers and a dedicated staff in place, do so because of the lack of effective governance. Proper governance will enable a project management office (PMO) to deliver a higher rate of success and client satisfaction. Project governance imposes processes that have a big impact—even when the processes seem small and inconsequential.

Kroll PMO and governance elements include dynamic budget and cost calculators, stakeholder communications, documentation management, defined escalation paths, status tracking and reporting, resource management and steering committee meeting preparation. The PMO will develop a project roadmap for a range of LIBOR transition situations highlighting dependencies, timelines and actions pending or overdue. The PMO will work with our experts to help monitor exposure related to contracts, prioritize risk and model impacts by utilizing advanced analytics.

Identifying exposures to firms’ Libor-linked products (derivatives, cash products) and other business lines is one of the first key steps of a successful transition. Our team will assess your firm’s exposure to LIBOR throughout the entire business, covering products and transactions associated with the benchmark. We will meet with key business stakeholders to assess the use of LIBOR in systems used for risk management and valuations.

Our team will document the result of the assessment surrounding the use of and exposure to LIBOR for each individual business area.

Kroll was engaged to analyze a firm’s exposure to market abuse risks, document and risk rate them and make recommendations for enhancing the existing control framework.

Decisions made in relation to the transition to LIBOR alternatives are likely to impact firms’ clients and therefore presents conduct risk. Firms should identify these conduct risks and set out how they will be mitigated. This will range from clear and effective communication with clients to considerations around which products may be offered to which groups of clients. Kroll has designed and implemented firm-wide conduct risk frameworks for a variety of firms and can support the potential conflicts of interest that can arise during the migration to LIBOR. Our team will be able to use our regulatory, valuations and disputes expertise to advise clients on the conduct risks involved in this transition.

Kroll was procured to conduct a detailed review of an investment bank’s conduct risk framework and program.

Our team will review how LIBOR is applied in your financial instrument models used for valuation, hedging, collateral and risk and understand how the transition to the replacement reference rate will impact these components.

Kroll Financial Instruments and Technology (FIT) team has an experienced group of quantitative analysts who can provide services around review of models, including implementation, system testing, valuation and risk impact, including hedging strategies and stress testing the transition, helping to identify issues beforehand.

Kroll was asked to provide support to a frequent securitization issuer who wanted to better understand how the LIBOR transition would affect varying LIBOR fallback provisions.

The end or LIBOR presents the need for financial institutions to identify and inventory the contracts that need to be amended and to do so under a tight deadline. This task is often referred to as “repapering.” While repapering of contracts is not a novel concept to many legal departments, replacing LIBOR will impact a significant number of financial agreements given the volume of these agreements that reference LIBOR and the uncertainty around its fallbacks A manual approach to scoping, outreach and remediation could be a daunting task that is fraught with risk and expense.

Kroll approaches the challenge with technology such as artificial intelligence (AI) and natural language processing (NLP) with robust applications for generation, negotiation and execution of contract amendments.

Learn more about our contract management services.

Firms may be to be subject to litigation over decisions made in relation to transitioning away from LIBOR. Our team of experts has deep experience in normal and stressed conditions and can provide support on a myriad of issues.

Learn more about our disputes consulting and litigation support services.

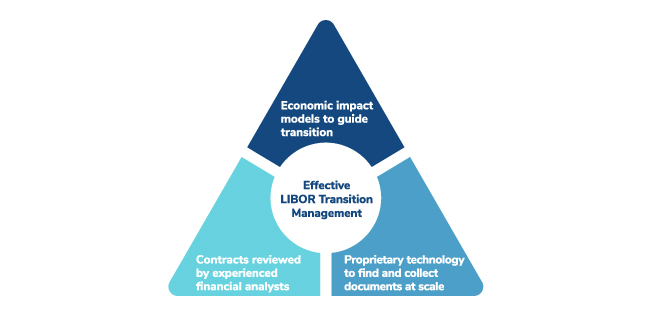

As the world’s premier provider of governance, risk and transparency solutions and the largest independent valuation provider in the world, our team merges a unique set of skills to provide effective management throughout the LIBOR transition initiative. Our approach combines robust models, proprietary technology and extensive contract management capabilities.

Kroll delivers a streamlined process of support the multitude of demands caused by the LIBOR transition. Our experts can help your firm manage the complete transition of systems, products, contracts and processes when replacing LIBOR in addition to identifying your LIBOR exposure, revising and updating valuation and risk models, and resolving any subsequent disputes.

Lean on Kroll for our vast array of subject matter experts with the background and experience to handle any steps necessary to mitigate risks associated with LIBOR replacement.