Regulatory Clarity

Form ADV Monitoring and Flagging

Regulatory Clarity is the first in a series of applications designed to support fund allocators such as endowments, foundations, public and private pensions, family offices, sovereign wealth funds, OCIOs and consultants that are seeking ongoing monitoring of fund investments. We recognize the unique needs of fund allocators and the challenges they face when investing in traditional and alternative funds across the U.S. and around the world. Our application is designed to provide you with the meaningful updates that your fund managers have made to their regulatory filings, which may require further inquiry or action. Regulatory Clarity enhances your monitoring process and may inform you of matters for consideration between due diligence visits.

About the Form ADV Flagging Tool

Kroll supports fund allocators with our process for monitoring critical information provided through the SEC’s Form ADV system. Our unique system monitors your fund investments, flags the changes for update importance and provides our clients with clear, easily understood information about why the change was flagged.

Managers are required to update their Form ADV filings annually, and more frequently if certain important changes are made. The filing changes may be mundane, important or critical:

- How will fund allocators keep on top of the changes?

- How will fund allocators determine if the updates and changes reflect normal business changes, or signal real problems with the manager?

Our proprietary flagging tool will sort the changes for you and provide you with our comments about what the changes mean and which changes you need to react to immediately.

Our Procedures to Capture and Flag the SEC Form ADV Changes

Identify Changes to Manager’s Regulatory Filings

Identify Changes to Manager’s Regulatory Filings

Every morning, Regulatory Clarity will review all the updates to Form ADV on the SEC’s website. Our system reviews the entire Form ADV filing including every answer to every question in every section, all the schedules to the filing, as well as the Disclosure Reporting Pages (DRPs) and the signature page. In our daily email we will identify the managers that make changes, flag the changes and then sort the changes into one of three categories:

- Green Flags: Normal business changes that are consistent with the manager’s conditions

- Yellow Flags: Changes that allocators should be aware of and other less common updates

- Red Flags: Business changes that are unusual, or changes that signal significant business or investment risks

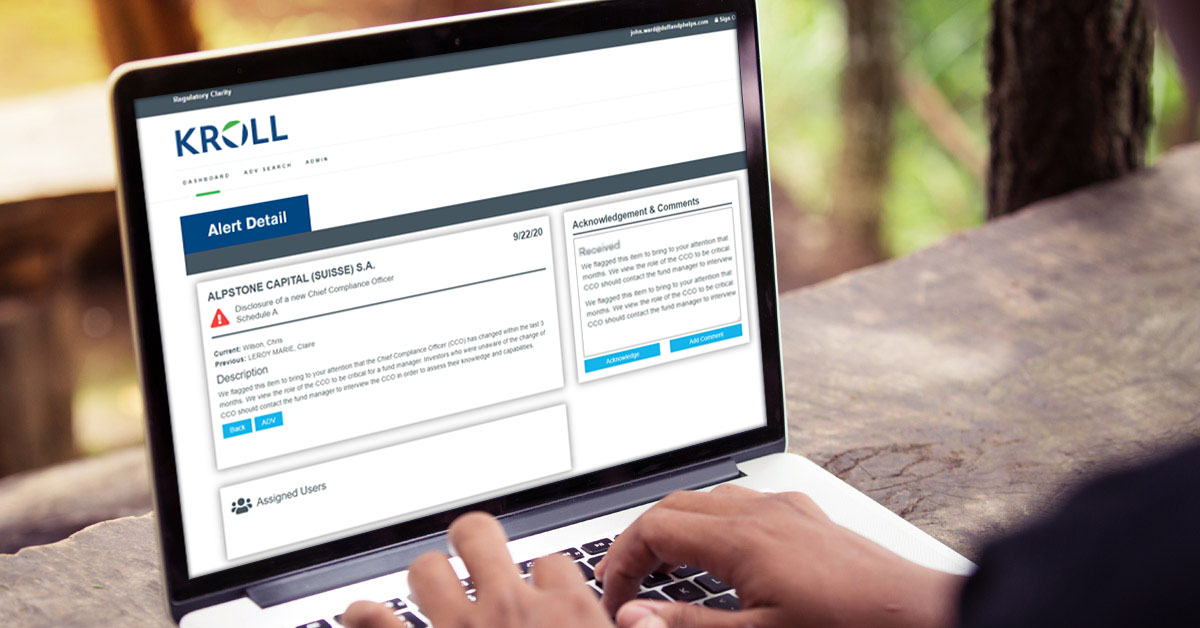

Why Form ADV Changes Matter

Why Form ADV Changes Matter

In addition to flagging the changes, we will explain why the issue is important, or perhaps critical. The Form ADV filing can be confusing and opaque to allocators that do not understand every change or why the change is signaling inconsistencies in the manager’s filing. Regulatory Clarity flags the changes and then it explains why the issues may be important to your firm. Regulatory Clarity will provide allocators with actionable information and not bury them with confusing data.

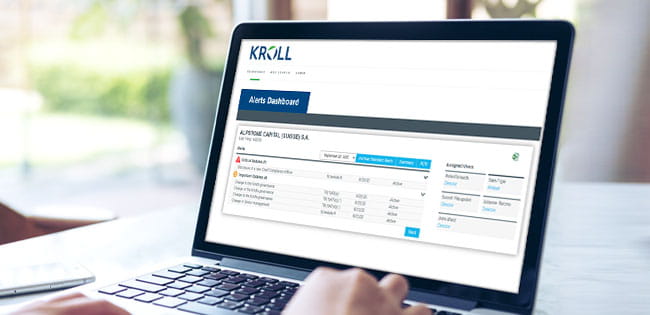

We Provide Your Organization with a Workflow Process

We Provide Your Organization with a Workflow Process

Regulatory Clarity was designed to meet the unique needs of fund allocators. Our system helps analysts and portfolio managers keep track of important changes, and who within your organization is following up with the fund manager through the following:

- Daily reports: These reports are broken down by fund analyst and by flagging type. Regulatory Clarity makes it easy for allocators to keep track of fund updates and follow-ups.

- Records: Regulatory Clarity allows users to add comments and notes to the Flagging Alert providing allocators with a complete timestamped audit trail.

- Review: Fund Allocators can use Regulatory Clarity’s Workflow Process to evidence Fiduciary Review of their fund investments.

- Export information: Regulatory Clarity provides an option to export all or selected alerts of interest which may be maintained for internal record keeping.

We Make the SEC’s Form ADV Information Easy to Understand

We Make the SEC’s Form ADV Information Easy to Understand

Regulatory Clarity was designed to make the complex Form ADV data easy to access and easy to understand:

- Historic information: Regulatory Clarity allows users to quickly see previous filings and to compare prior Form ADV filings.

- Firm overview: We have developed our unique Firm Overview Report which summarizes the most commonly accessed parts of the Form ADV into a 2-3-page document. The Firm Overview includes all the information regarding the firm’s RAUM, headcount, fund information, firm ownership, and any critical DRP reports. The Overview report can be easily exported into a pdf document.

- Easy to read form ADV filings: The IAPD system is not user friendly and searching for important data is cumbersome. Additionally, the Form ADV printouts are hard to read and interpret. Regulatory Clarity allows for reading and printing clean, clear and precise reports.

Register for Demo

Valuation

Valuation of businesses, assets and alternative investments for financial reporting, tax and other purposes.

Cyber Risk

Incident response, digital forensics, breach notification, managed detection services, penetration testing, cyber assessments and advisory.

Compliance and Regulation

End-to-end governance, advisory and monitorship solutions to detect, mitigate and remediate security, legal, compliance and regulatory risk.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Investigations and Disputes

World-wide expert services and tech-enabled advisory through all stages of diligence, forensic investigation, litigation, disputes and testimony.

Digital Technology Solutions

Enriching our professional services, our integrated software platform helps clients discover, quantify and manage risk in the corporate and private capital market ecosystem.

Business Services

Expert provider of complex administrative solutions for capital events globally. Our services include claims and noticing administration, debt restructuring and liability management services, agency and trustee services and more.

Environmental, Social and Governance

Advisory and technology solutions, including policies and procedures, screening and due diligence, disclosures and reporting and investigations, value creation, and monitoring.

Alternative Investments Conference 2021

Welcome and Opening Remarks

Alternative Investments Conference 2021

Global Macroeconomic Overview

Alternative Investments Conference 2021

Global Alternative Asset Outlook & Valuation Update

Alternative Investments Conference 2021

Public vs. Private Markets