Thu, Oct 17, 2019

Millennials Value Car Ownership - Will the Trend Continue?

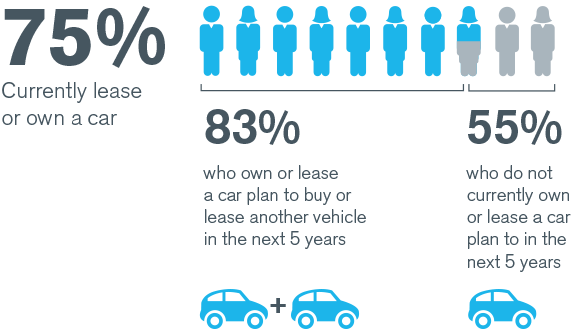

The future isn’t certain, but 75% of the respondents to our global survey currently own or lease a car–and of that group, 83% expect to purchase or lease another car in the next five years. Diving into different regions also provided important information about the future of car ownership.

Global Ownership or Leasing of Cars is High for Millennials

At a regional level, responses across Asia varied the most. China (other than Hong Kong) and India had very high levels of respondents who own or lease, at 89% and 87%, respectively. Hong Kong and Singapore reported lower levels, at 62% and 46%, respectively. Japanese respondents reported average levels of ownership or leasing at 71%.

The high percentages in China (other than Hong Kong) and India are not that surprising given the growth in automotive sales in those countries over the last decade as well as the status attached to car ownership, particularly in China.3 Lower ownership and leasing rates in Hong Kong and Singapore likely stem from highly regarded public transportation systems in those countries. Additionally, Singapore’s government limits4 the number of license plates and has enacted high taxes on car ownership.

Tracking with the global findings, 83% of Asian car owners who responded to the survey expect to buy or lease another car in the next five years, with only Japan well below that mark at just 67%. China (other than Hong Kong) was somewhat of an outlier (in Asia) on the other end of the spectrum with 92% expecting to buy or lease another car in the next five years–a surprising finding given that car sales in China are declining5 for the first time since the 1990s.6 Millennials in China may be optimistic about their medium- to long-term economic prospects despite the current market downturn.

Will Millennials Buy or Lease Vehicles Over the Next 10 years?

The U.S. at 74% and Germany at 77% on the low end relative to global respondents. While this is still a high level of respondents that expect to purchase or lease a new car in the next five years, car sales in these countries have started7 to decline8 after historically high rates for the last several years. Millennials in these countries were significantly more impacted by the Great Recession than the Chinese9 and may be more concerned about their economic prospects given the current economic uncertainty.

Regarding current rates of owning or leasing cars, Latin America was last (slightly behind Asia). But respondents in Latin America with cars were most likely to buy or lease a new one in the next five years, at 92%. When looking at other continents, respondents in the U.S. and Canada were the least likely to buy or lease a new car in the next five years at 77%, while Europe responded at the global rate of 83%.

For the 25% of global respondents who do not own or lease a car, a significantly lower percentage expect to purchase or lease another car in the next five years. Fifty-five percent of respondents expect to purchase a car in the next five years, compared to the 83% who answered affirmatively and already own or lease a car.

The implication for the auto industry is that almost 75% of millennials expect to purchase or lease a new car in the next five years. When extrapolated to the full millennial population, this indicates the potential for a substantial uptick in car purchases in the coming years.

Regardless of qualifiers, the sentiment behind the findings is great news for an automotive industry currently enduring some global headwinds. However, it should be noted that 11% of the survey respondents who do not currently own or lease a car never expect to get one, indicating a segment of the population that is likely unreachable.

Sources

3 “Why Do the Chinese Love Long Wheelbase Cars?,” OneShift, accessed September 25, 2019, https://www.oneshift.com/features/11805/why-do-the-chinese-love-long-wheelbase-cars.

4 Mimi Kirk, “In Singapore, Making Cars Unaffordable Has Only Made Them More Desirable,” City Lab, accessed September 25, 2019, https://www.citylab.com/transportation/2013/06/singapore-making-cars-unaffordable-has-only-made-them-more-desirable/5931/.

5 “Chinese Automobile Sales Decline for 14th Time in 15 Months,” Bloomberg, accessed September 25, 2019, https://www.bloomberg.com/news/articles/2019-09-09/chinese-automobile-sales-decline-for-14th-time-in-15-months.

6 Yilei Sun and Brenda Goh, “China car sales hit reverse for first time since 1990s, Reuters, accessed September 25, https://www.reuters.com/article/us-china-autos/china-car-sales-hit-reverse-for-first-time-since-1990s-idUSKCN1P805Z.

7 Dave Royse, “Declining Car Sales Help Drive Germany Toward Recession,” Yahoo Finance, accessed September 25, https://finance.yahoo.com/news/declining-car-sales-help-drive-162158679.html.

8 Nick Bunkley, “8 first-half sales tales, Automotive News, accessed September 25, https://www.autonews.com/sales/8-first-half-sales-tales.

9 Yi Wen and Jing Wu, “Withstanding Great Recession Like China, SSRN, accessed September 25, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2407164.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Private Capital Markets – Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.

Fairness and Solvency Opinions

Duff & Phelps Opinions is a global leader in Fairness Opinions and Special Committee Advisory, ranking #1 for total number of fairness opinions in the U.S., EMEA (Europe, the Middle East and Africa), Australia and Globally in 2023 according to LSEG (FKA Refinitiv).

Industrials Investment Banking

Industrials expertise for middle-market M&A transactions.

Technology Investment Banking

Technology expertise for middle-market M&A transactions.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Investigations and Disputes

World-wide expert services and tech-enabled advisory through all stages of diligence, forensic investigation, litigation, disputes and testimony.